A.I.S. Resources Signs Binding LOI to Acquire the Toolleen-Fosterville Gold Project EL006001

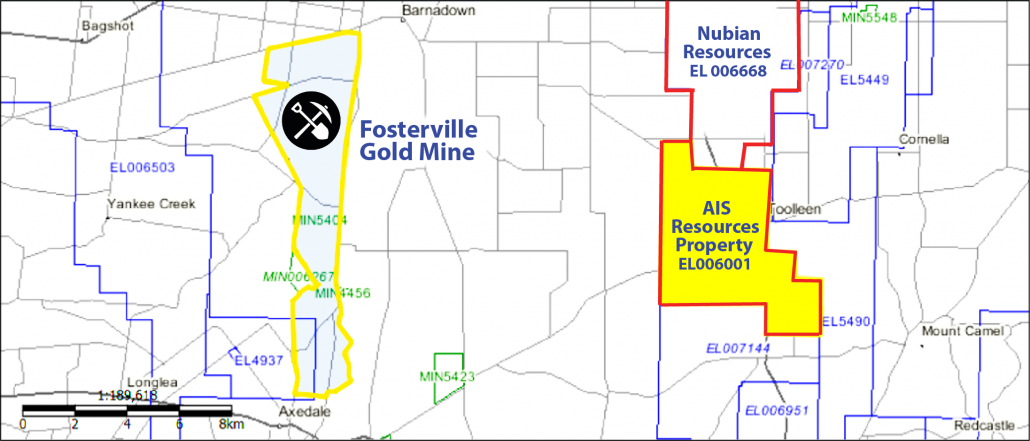

Vancouver, British Columbia – A.I.S. Resources Limited (TSX: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announces that on August 24th, 2020 the Company entered into a Binding Letter of Intent (“LOI”) with Providence Gold and Minerals Pty Ltd (“PGM”), to acquire the Toolleen-Fosterville Gold project (the “Project”) located 3 km from the township of Toolleen and 12 km from the Kirkland Lake Fosterville gold mine. The Project is situated on freehold land and has no native title claim.

Fig 1 – The newly announced 26 sq. km. Toolleen-Fosterville Project shown in yellow is conveniently located only 42 miles from Bendigo, and 12 km from the 7.58 Moz Au Fosterville Gold Mine.

Fig 1 – The newly announced 26 sq. km. Toolleen-Fosterville Project shown in yellow is conveniently located only 42 miles from Bendigo, and 12 km from the 7.58 Moz Au Fosterville Gold Mine.

Close to the 7.58Moz. Gold Fosterville Mine

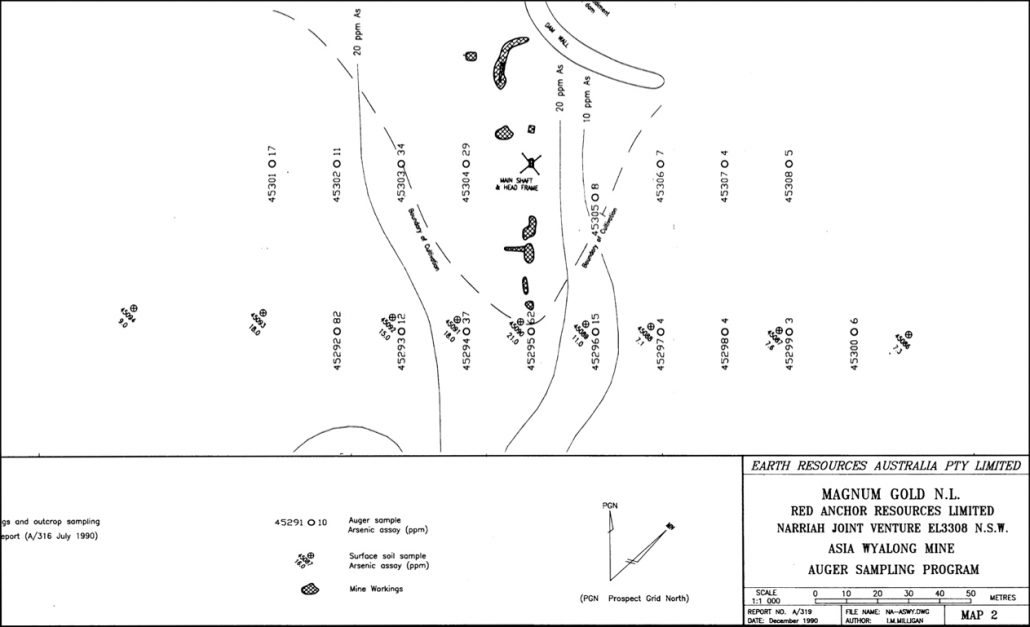

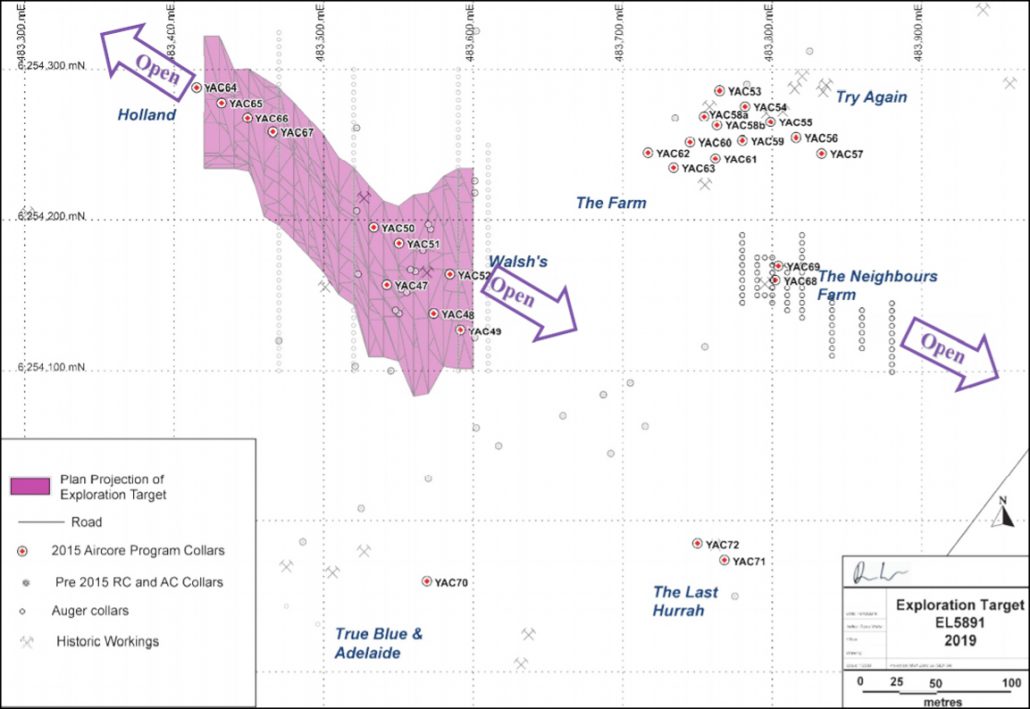

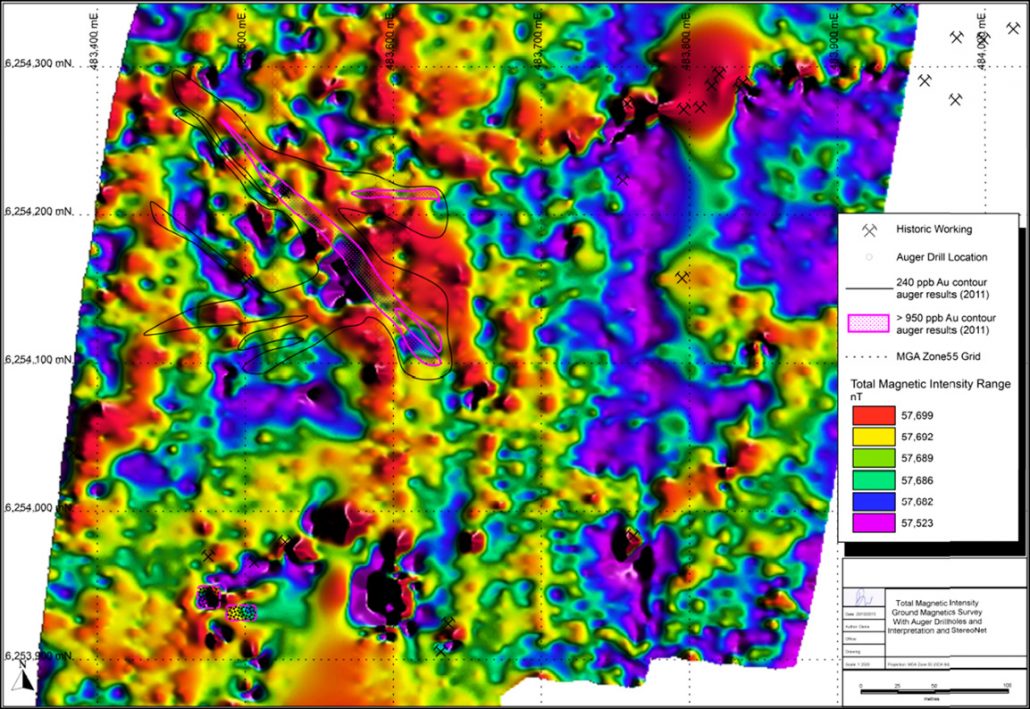

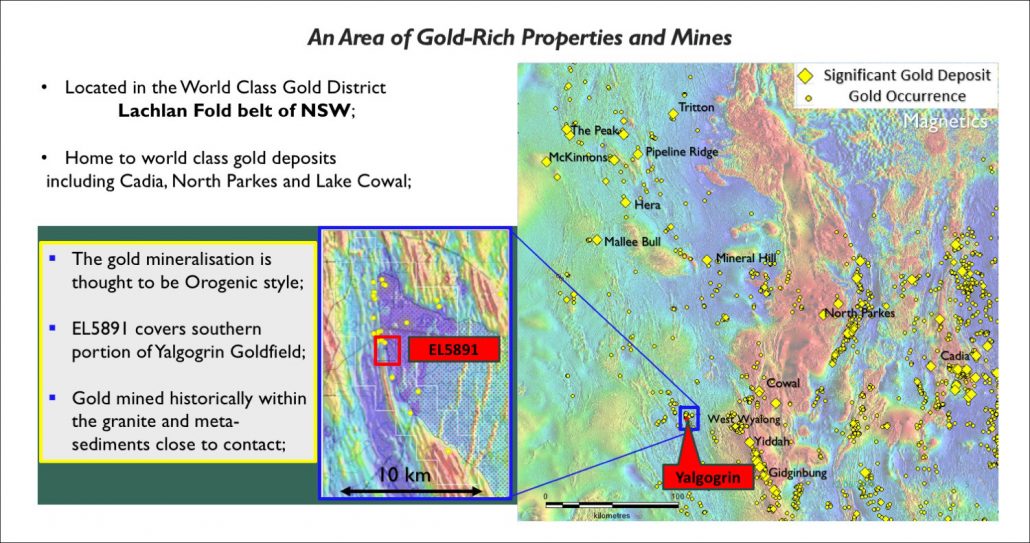

AIS President & CEO, Phillip Thomas commented, “With the Toolleen-Fosterville Project’s close proximity to the 7.58 Moz. goldFosterville Mine(Kirkland Lake Gold–KL-NYSE) we are in good company. To be able to acquire a property with an open cut mine, free gold on the surface, substantial geological work and evidence of quartz augurs well. Other explorers around our new project include: Fosterville South Exploration (FSX-V), Nubian Resources (NBR-V), Catalyst Metals (CYL-AX), and Petratherm Limited (PTR-AX). The Project area, which is adjacent to the recently lifted exploration moratorium area, is located within the Bendigo-Ballarat Zone of the Palaeozoic Lachlan Fold Belt of eastern Australia and the greenstone corridor running north south. The gravity survey shows highly prospective areas. The experience at Fosterville and Bendigo suggests that the shallow gold mineralisation may be indicative of high-grade shoots that can be mined by underground methods. This exploration project is a perfect addition to the AIS Resources’ more advanced exploration stage Yalgogrin Gold Project. The Company is finalizing definitive agreements for the Yalgogrin and Toolleen-Fosterville Gold Projects and is looking forward to executing its exploration plans in Australia.”

Toolleen-Fosterville Project Acquisition Terms

Under the terms of the LOI, AIS Resources will acquire 100% interest in the Project, by paying AU$375,000 (CAD$356,250) and issuing AIS shares equal to AU$375,000 (CA$356,250) to the Vendor, PGM. A 1% NSR is payable on all gold production. The Acquisition is expected to occur by September 14, 2020 and is subject to the receipt of all necessary approvals and all conditions having been satisfied or waived with respect to the terms of the LOI including the approval of the TSX Venture Exchange.

The vendor’s geologist, Dr. Rodney Boucher, a pre-eminent Geologist with over 25 years experience in central Victoria geology will be assisting in the handover and future work on the Project. Several prospectors have been on the EL tenement ground and surrounding tenements and have recovered surface gold.

Fig 2 (L) – Open cut mine on the northern extent of the property • Fig 3 (R) – Dr. Boucher (foreground) inspecting the surface scree while discussing paleochannel and reef evidence with Tom Burrowes of PGM.

Fig 2 (L) – Open cut mine on the northern extent of the property • Fig 3 (R) – Dr. Boucher (foreground) inspecting the surface scree while discussing paleochannel and reef evidence with Tom Burrowes of PGM.

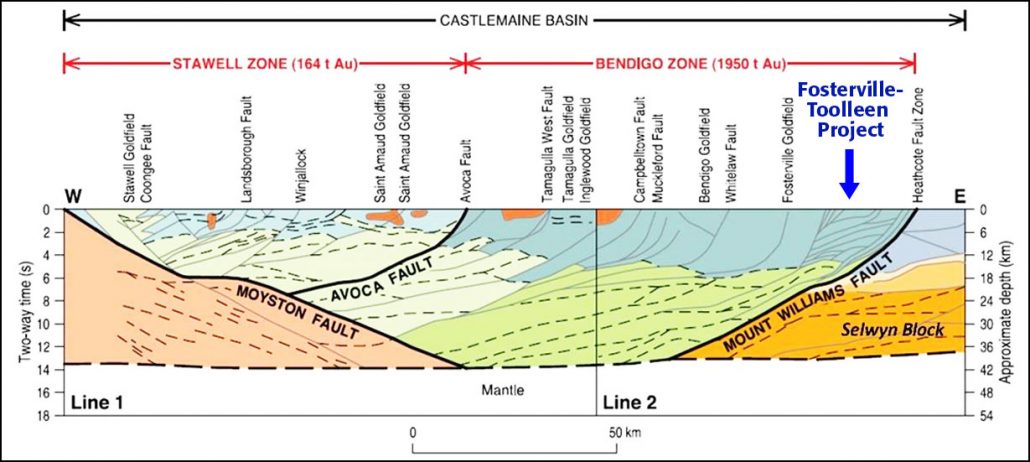

Local Geology Prospective for Gold Deposits

The Toolleen Gold Zone was mined underground until 1957 with a reported 7,000 tonnes @ 10g/t Au being produced from the top 60 metres. Willman (2007) showed that the best mineralisation at both Bendigo and Castlemaine was found a few kilometres into the hanging walls of major faults thus, these areas of shallow cover are both prospective and easy to explore. PGM had previously discovered the Four Eagles project operated now by Catalyst Metals in the hanging wall in a similar position. The Mt William Fault transects the tenement in a north-west south-east direction.

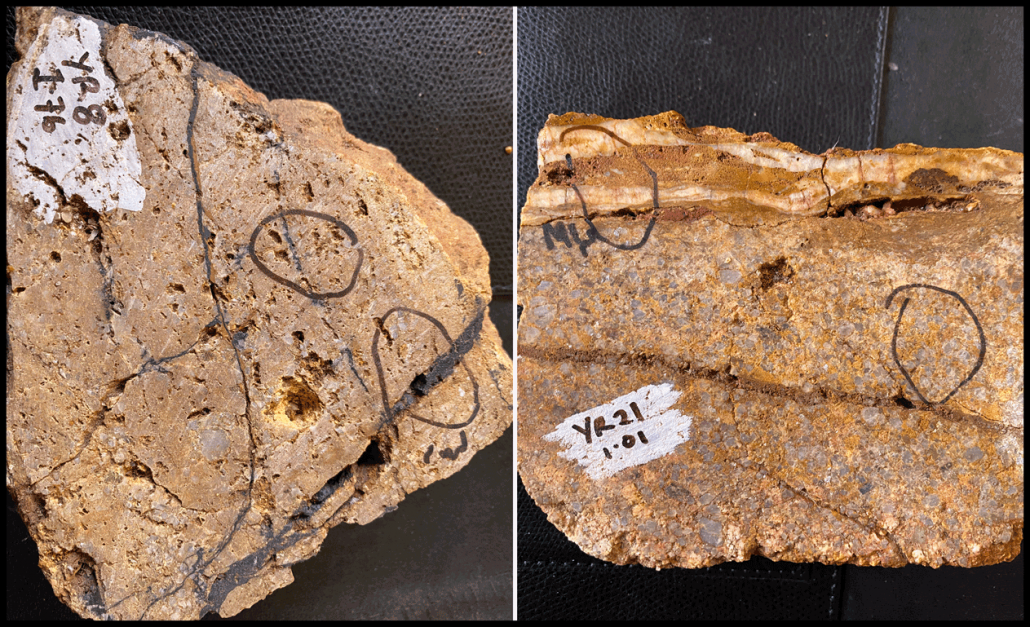

Fig 4 (L) – Gold nuggets recovered from one of the farms on EL6001 • Fig 5 (R) – Angular reef quartz and rounded glacial quartz scree of Permian glacial origin.

Fig 4 (L) – Gold nuggets recovered from one of the farms on EL6001 • Fig 5 (R) – Angular reef quartz and rounded glacial quartz scree of Permian glacial origin.

The Lachlan fold belt has been subdivided into eight zones based on age, rock types and structural history (Grey, 1988). The Permian glaciation is evidenced by small subsurface and locally outcropping occurrences of glacigene sediments that provide evidence of the glaciation. This occurred in eastern Australia during the lower Permian affecting the Toolleen area. Fluvio-glacial and glacial sediments crop out poorly and tend to be preserved in down faulted blocks or have been reworked into younger deposits. EL006001 is east of the Mt William fault.

Fluvial sediments have reworked Palaeozoic reef quartz and gold along with Permian glacial clasts into ancient rivers that criss-cross the tenement during the Cenozoic. Fosterville is unique in the region as it represents a large North striking West dipping fault reef up to 20 metres wide and eight kilometres long hosting rich gold reefs with finely disseminated gold. . Fosterville was attractive due to the arsenopyrite-hosted, fine disseminated folding (even though it wasn’t unique with similar mineralisation at Nagambie & Bailieston and even in small parts of Bendigo and Daylesford), but has become famous for the abundant nuggetty gold.

At the deposit scale, high-angle secondary reverse faults and dilational cross structures served as conduits for the mineralising fluids. In addition to the fault-controlled mineralisation, where accommodation occurs at the apexes of tight fold hinges, mineralisation can occur as stacked ‘saddle’ or ‘trough’ reefs as commonly seen within the Bendigo area.

Fig 6 – Faults and block movements in the Toolleen and surrounding area.

Technical information in this news release has been reviewed and approved by Phillip Thomas, CEO of AIS, who is a Qualified Person under the definitions established by the National Instrument 43-101.

About A.I.S. Resources Limited

AIS Resources Ltd. is a publicly traded investment issuer listed on the TSX Venture Exchange focussed on precious and base metals exploration. The Company is managed by a team of experienced mining and geological professionals. AIS has been involved in manganese trading from mines in Peru. In July 2020, AIS entered into an agreement to acquire and develop the Yalgogrin Gold Project in central New South Wales, Australia.

A.I.S. Resources Ltd.

For further information, please contact:

Phillip Thomas, Chief Executive Officer

T: +1-747 200 9412

E: pthomas@aisresources.com

Or

Martyn Element, Executive Chairman

T: +1-604 687 6820

E: melement@aisresources.com

Website: www.aisresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ADVISORY: This press release contains forward-looking statements. More particularly, this press release contains statements concerning the anticipated use of the proceeds of the Private Placement. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The intended use of the proceeds of the Private Placement by the Corporation might change if the board of directors of the Corporation determines that it would be in the best interests of the Corporation to deploy the proceeds for some other purpose. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)