In the midst of tax loss selling across many sectors—not just battery metals (lithium, cobalt, manganese, vanadium, etc.) but cannabis/hemp segments as well (and most other metals/mining/mineral sectors)—A.I.S. Resources Ltd. (AIS:TSX.V; AISSF:OTSQB) recently announced good news. Is the market ignoring ongoing positive developments at the company?

.

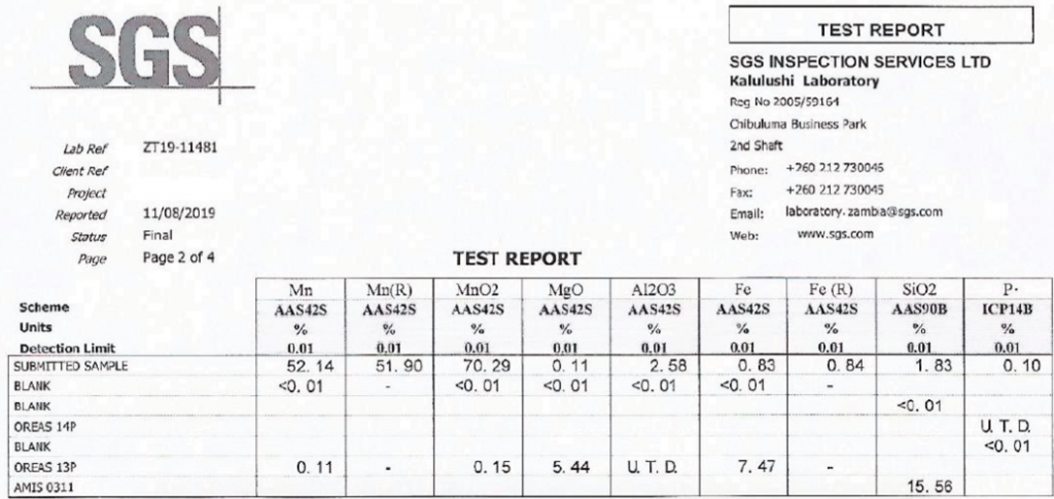

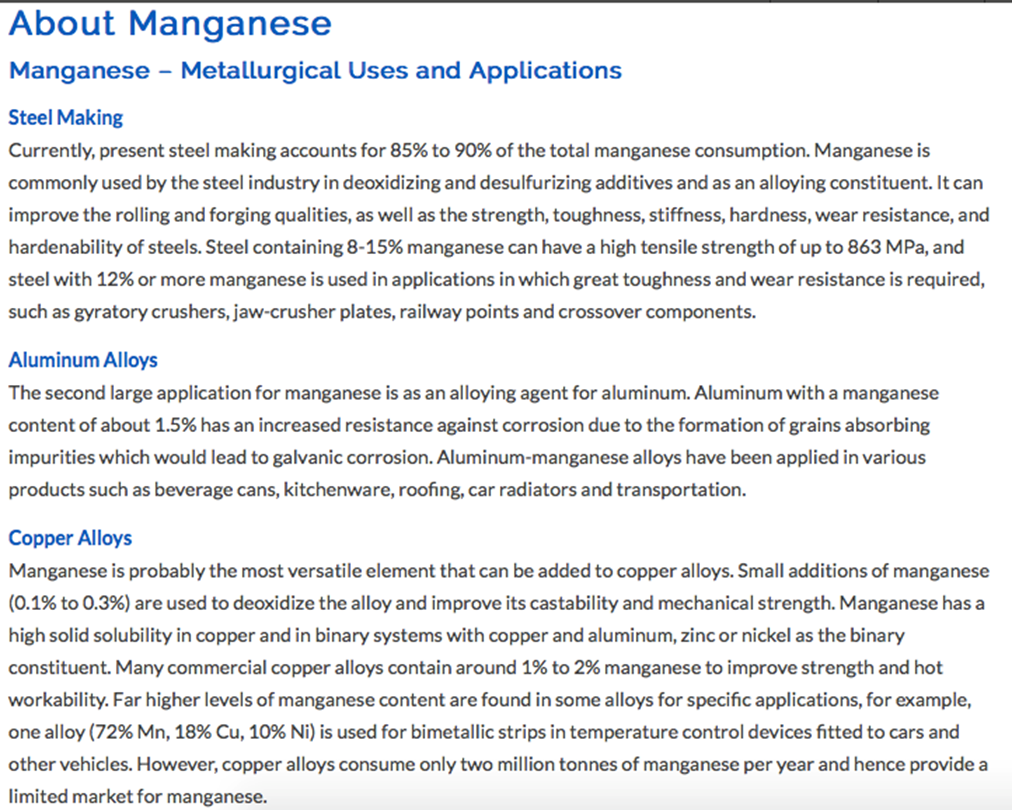

Management has successfully arranged for the supply of up to 30k tonnes/month of high-grade (48%–52%) Manganese (Mn) to China and is embarking on a trial shipment of 5–10k tonnes. Reaching this significant tonnage (which is not a sure thing) has been a consistent goal since April/May. If A.I.S. achieves 20k–30k tonnes/month, it would be an excellent outcome, assuming it can consistently deliver in that range.

Management has arranged the Mn sourcing with two African suppliers, and is negotiating a supply agreement with giant, multi-billion dollar Erdos Group, one of the world’s largest buyers of Mn. A.I.S. has issued a term sheet for a trial shipment of 5–10k tonnes, expected in January. The fact that Erdos is willing to work with A.I.S. is an impressive vote of confidence in the management team.

The trial shipment will reportedly gross ~US$2 million, subject to a final delivered grade of ~50% Mn. A.I.S. will be responsible for all logistics, including quality control, assays, shipping and related activities.

Additional suppliers from Brazil and Panama, among other places, have approached management about selling ore into A.I.S.’ trading strategy. Negotiations are underway. Importantly, detailed discussions are being held with trade and project financiers from London, Dubai and Canada to facilitate payments for the purchase and shipment of Mn ore to China. Although a risk factor, management believes that obtaining trade financing will not be problem.

This news comes on the heels of another positive development, but one that failed to capture investor’s need for instant gratification. On October 24th, management locked down an option to acquire an initial 51% interest in a gold mine in northern Peru. The mine is currently producing small quantities of gold.

After completing due diligence and determining the extent and concentration of gold mineralization, A.I.S. will contribute US$500k worth of equipment and technical expertise to increase mine productivity. Low-cost due diligence efforts will focus on drilling, soil sampling, mapping and design of a process circuit. The target is 8–10 vein systems with up to 5,000 tonnes of ore in each, grading 10g/t Au or better.

Investors have questions about this new gold project: How long will it take to do proper due diligence? Will A.I.S. need to raise additional equity capital? Company-wide funding is a concern; management needs to come up with trade finance for Mn trading, cash or a gold loan for the new gold project, and US$1 million for a 15% investment in a private lithium extraction technology company.

.

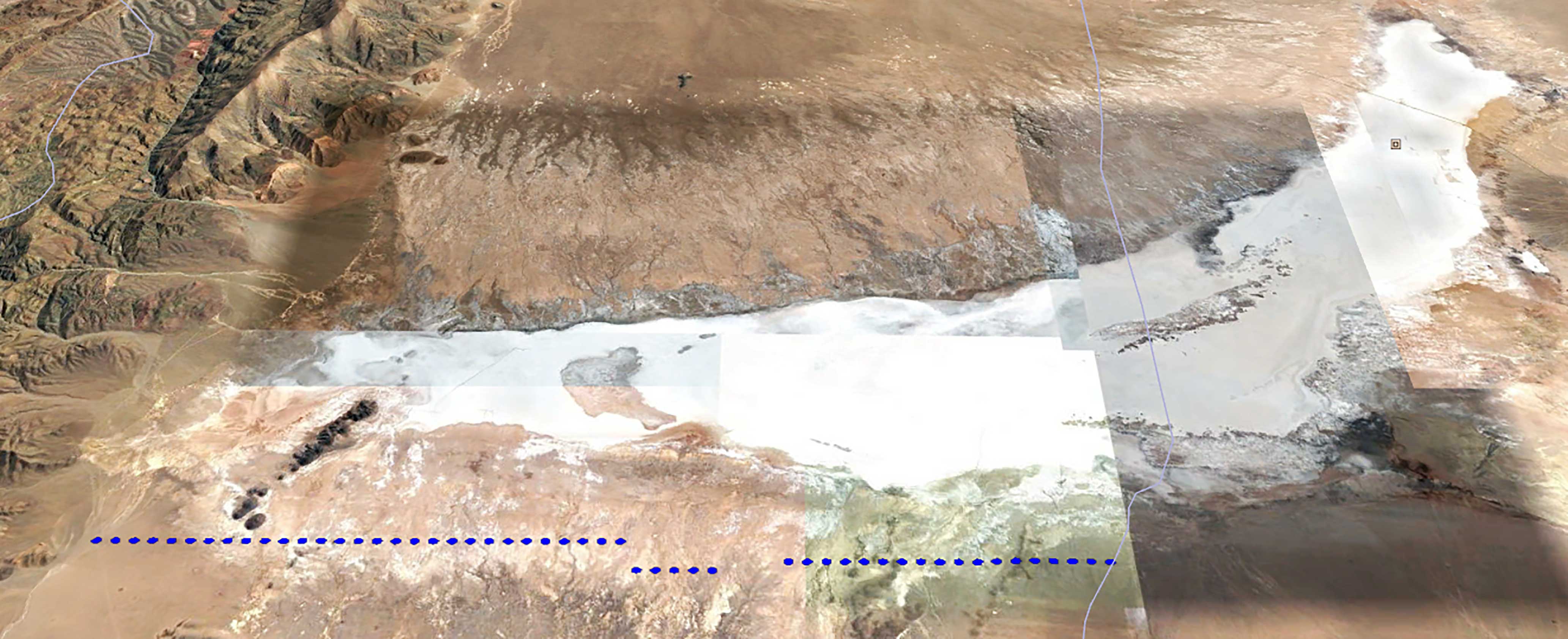

Readers may recall that on October 8th, A.I.S. signed an option agreement with Ekos Research, requiring an investment of US$1 million, for a 15% stake in a breakthrough lithium solvent extraction process that produces lithium chloride with 99.2% purity, but more importantly can manage high-magnesium bearing brines found in salars in Argentina like Rincón and Salinas Grandes.

Rapid lithium extraction (without solar evaporation ponds), with high recoveries and purity levels, and a strong environmental profile, is the holy grail. There are dozens of technologies in the works, but none (that I’m aware of) are operating at full commercial scale anywhere in the world.

Management gave me an example of a 20,000 tonne per year lithium carbonate plant that could reduce its cap-ex from $560 million to $210 million by using this new technology. With no evaporation ponds, the process can easily be turned on and off, and there’s no ground water issues.

How far will US$1 million take this emerging technology? While I have respect for the A.I.S. technical team being able to expertly evaluate a promising lithium extraction technology, it could take years to reach meaningful cash flow (net to the company’s 15% interest).

Ekosolve is building a semi-commercial scale demonstration plant for under US$1 million, so the cash contributed by A.I.S will go directly into this demonstration plant with a nine-month build. I’m told there is at least one producer having their brines tested now.

.

Is management spreading themselves too thin? The company is now reportedly pursuing three projects at once; lithium technology, manganese trading and a gold joint venture, spanning several countries (Peru, Australia, Tanzania, China). Management doesn’t think so, and they’re only actively spending on Mn trading at the moment. Gold project due diligence costs are said to be minimal.

CEO Phil Thomas has more than 17 years’ experience in lithium technologies being highly qualified in geochemistry especially lithium, worked for more than 15 years in trading ores and has explored and operated five gold mines, with eight staff in Peru and two in China. Phil is based in Australia.

Yes, the shares of A.I.S. Resources remain highly speculative, but the upside potential is bigger than ever before. Can a company with a $3.8 million market cap (83.4 million shares at $0.045) move its Mn project forward over the next 3, 6, 12 months without massive equity dilution?

I like the diversification here, Mn, Au (gold) + a Li extraction technology. Management saw the decline in lithium prices and prudently dropped their Guayatayoc lithium project. Consider the difference in pricing of lithium (down a lot) and gold (up moderately). A year ago, A.I.S. was solely an Argentina lithium brine play. If management had not branched out into other sectors, the company would be dead in the water like many others in South America’s Lithium Triangle.

If all goes according to plan, which is rarely the case for somewhat complex logistical operations, A.I.S. has the opportunity to become cash flow positive within six months. I think it’s great that cash flow from Mn trading could be deployed into a gold project rather than a lithium brine story in Argentina.

Although the avoidance of further equity dilution is very important to the management team, readers should probably assume some equity issuance as a necessary evil. A.I.S. should be able to get by with a modest raise before reaching cash flow break even next year. There’s reason to expect only minimal equity dilution because management believes it can secure trade/working capital financing. The announcement of non-dilutive financing working cap would be a tremendous de-risking event.

.

Bottom line, A.I.S. Resources (TSX-V – AIS, OTCQB: AISSF) is worth a lot more than $3.8 million if it can reach 20k–30k tonnes/month of Mn trading. Management has a number of boxes checked in this endeavor, but there are more boxes to tick.

Working with Erdos and sending them a sizable (trial) bulk shipment is great news, but timing is everything. A three-month delay in reaching 20k–30k tonnes/month could make a big difference in the number of shares outstanding.

However, to reiterate, if all goes reasonably as planned, there’s substantial upside from the current $3.8 million valuation.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about A.I.S. Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of A.I.S. Resources are highly speculative, not suitable for all investors. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of A.I.S. Resources and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts, financial calculations, etc., or for the completeness of this interview or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)