A.I.S. Resources Signs Fosterville-Toolleen and Kingston Gold Project Agreements and Announces Financing

November 17, 2020

Vancouver, British Columbia – A.I.S. Resources Limited (TSX: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announces that it has signed definitive agreements to acquire the Fosterville-Toolleen and Kingston Gold Projects.

Our Primary Focus is the Fosterville-Toolleen Drill-ready Gold Project

AIS’s primary focus in the near term will be to make Fosterville-Toolleen drill ready. Exploration Licence EL006001 is located only 12 km from and is the closestproperty toKirkland Lake’s 9 Moz Au* Fosterville Gold Mine. The Fosterville Mine is the biggest producing mine in Victoria, Australia (619,000oz in 2019) and one of the richest grade mines in the world at 31gm/t gold. To date the Fosterville Mine has produced more than 2million oz of gold worth more than US$3.7 billion at today’s prices. Fosterville-Toolleen covers an area of 26 km2– approximately the same size as the Fosterville Mine’s 28 km2.

The AIS management team is delighted with the acquisition because:

- approximately 30-45oz of gold nuggets have been located on the Exploration Licence,

- an open cut alluvial mine has been operated and there are two unnamed historic shafts.

With the Mt Williams fault nearby there are many geological similarities to the Fosterville Mine. There is significant market anticipation on the results of the Dept. of Jobs Precincts and Regions tender for block 3 and block 4, which will be awarded in March 2021 and are adjacent to Toolleen. Earth Resources Victoria estimated that 75 million oz of gold remains undiscovered in central Victoria.

AIS Resources Prepares for Drilling

Preparations are being made to conduct a Deep Ground Penetrating Radar (DGPR) geophysics program on the property in December 2020 and a geochemical soil survey to continue the work completed to date. This will enhance the targeting of drill locations, which is scheduled for the new year.

Fig 1. The 26 km2 Toolleen Property is located 12 kms from the 28.47 km2 Fosterville Mine property.

Fig 1. The 26 km2 Toolleen Property is located 12 kms from the 28.47 km2 Fosterville Mine property.

Fosterville Goldfield’s Rich Geological Structure

The Fosterville goldfield is hosted in Lower Ordovician turbidite sediments and is located in the eastern margin of the Bendigo-Ballarat Geological Zone. The sediments are an undifferentiated sequence of sandstones, siltstones and shales, which have subsequently been folded. The same geology can be seen on the Fosterville-Toolleen property. Faults are well developed throughout the area, with the Fosterville Fault being the dominant structure exhibiting a strike length of >8km. The Fosterville goldfield is composed of numerous deposits, which are located along two main controlling structures: The Fosterville Fault and the O’Dwyers South Line.

The Fosterville Robbin’s Hill open cut mine has total mineral resources of about 1.0m oz averaging 4.0gm/t with much higher grades and resources at depth. They successfully mined the alluvials and subsequently targeted the deeper reef gold in black shales and quartz.

Gold nuggets from the Devonian glacials, transported from nearby reef systems have been found on the EL006001. The Mt Williams fault is on one side of the property and the Whitelaw fault on the other side.

These gold nuggets are mostly well water-worn but some nuggets are attached to quartz, which implies a local source. Quartz reefs are known to be in the vicinity in addition to multiple older leads and they could both be the source of the nuggets at Toolleen.

Toolleen Initial Exploration Strategy – Alluvial Leads

The initial exploration strategy for Toolleen focusses on assessing the potential of the alluvial leads that have been a source of gold for Fosterville in their open pit mining. The DGPR tests were conducted to confirm the location of the alluvial terraces and gain an understanding of their shape and dimensions. Shallow air core drilling followed. To date, only a small section of the EL006001 has been explored.

The survey results are interpreted to show alluvial terraces down to approximately 10m depth and up to 50m width, with internal gutters. AIS Resources intends to use geophysics to improve targeting of the drill holes, and conduct bulk sampling in past pits and unnamed shafts.

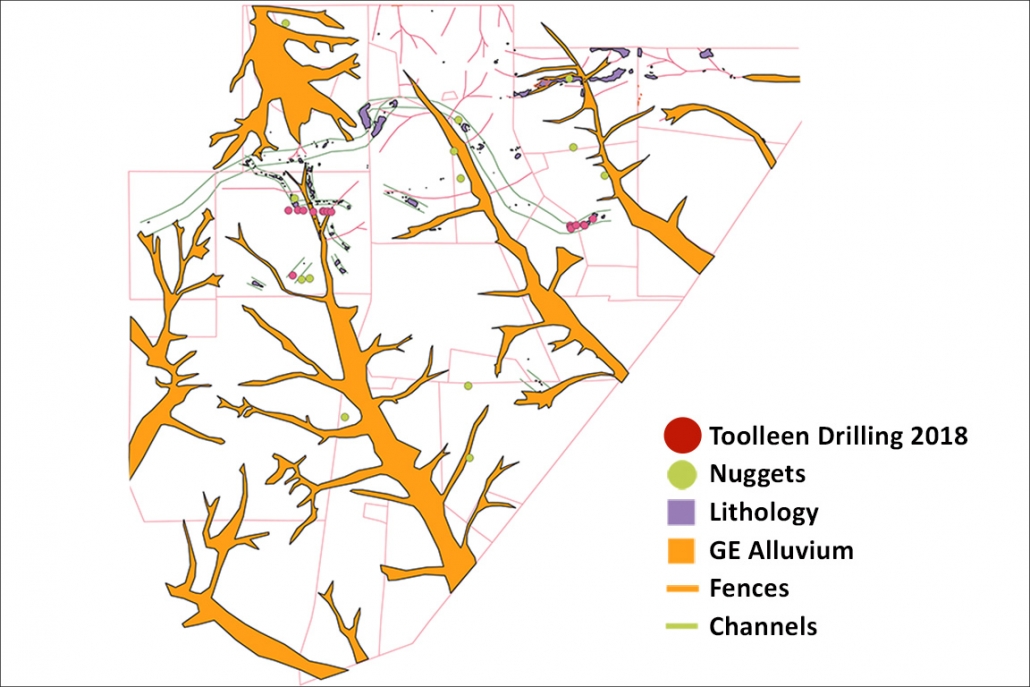

Fig 2. Fosterville-Toolleen – Location of gullies with gold bearing alluvium

Toolleen-Fosterville Acquisition Terms

AIS will acquire 100% interest by paying AU$375,000 (CAD$356,250) and issuing AIS shares equal to AU$375,000 (CA$356,250) to the Vendor. A 1% NSR is payable on all gold production. AIS has paid a deposit of AU$200,000 and will pay the balance of the cash and issue the shares upon acceptance of the TSX Venture Exchange.

Kingston Acquisition Terms

AIS will make a partial payment of AU$125,000. Upon receipt of TSXV acceptance AIS will pay an additional AU$125,000 and issue 4,000,000 common shares of the Company and 4,000,000 share purchase warrants exercisable at CAD$0.15 for a period of five years. The Vendor will retain a 1% NSR up to a cap of 50,000 oz of gold. In summary, AIS will receive 15% of gold sales revenue from the Vendor’s mining activities outside of the Vendor’s PL007020 on the EL006318 where the shaft started inside PL007020. AIS’s plans for Kingston will be described in a dedicated news release to be issued in the near future.

Private Placement Financing

In conjunction with the signing of the definitive agreements AIS announces a non-brokered private placement of up to 10,000,0000units (“Units“) at a price of $0.07 per unit for gross proceeds of $700,000. (the “Private Placement“). The proceeds will be used for acquisition and exploration costs and general working capital purposes.

Each Unit consists of one common share and one transferrable share purchase warrant. Each warrant will entitle the holder thereof to purchase one additional common share for a period of 12 months from the closing date of the offering at a price of $0.10 per common share provided that if the closing price of the common shares of the Company on any stock exchange or quotation system on which the common shares are then listed or quoted is equal to or greater than $0.15 for a period of fifteen (15) consecutive trading days, the Company will have the right to accelerate the expiry of the warrants to a date that is not less than ten (10) business days from the date notice is given.The Company may pay finders fees of up to 8% cash and 8% finders warrants on a portion of the placement.

Closing of the Private Placement is subject to acceptance by the TSX Venture Exchange. All securities issued in connection with the Private Placement will be subject to a four-month hold period from the closing date under applicable Canadian securities laws.

Certain directors and officers are expected to participate in the Private Placement. Such participation is considered a related party transaction within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The related party transaction will be exempt from minority approval, information circular and formal valuation requirements pursuant to the exemptions contained in Sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the gross securities to be issued under the Private Placement nor the consideration to be paid by the insiders will exceed 25% of the Company’s market capitalization. A material change report will be filed less than 21 days before the closing date of the transactions contemplated by this news release. The Company believes this shorter period is reasonable and necessary in the circumstances.

The Private Placement securities have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “1933 Act”), or under any state securities laws, and may not be offered or sold, directly or indirectly, or delivered within the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) absent registration or an applicable exemption from the registration requirements. This news release does not constitute an offer to sell or a solicitation to buy such securities in the United States.

Technical information in this news release has been reviewed and approved by Phillip Thomas, CEO of AIS, who is a Qualified Person under the definitions established by the National Instrument 43-101.

About A.I.S. Resources

A.I.S. Resources Limited is a publicly traded investment issuer listed on the TSX Venture Exchange focused on precious and base metals exploration. AIS’s value add strategy is to acquire prospective exploration projects and enhance their value by better defining the mineral resource with a view to attracting joint venture partners and enhancing the value of its portfolio. The Company is managed by a team of experienced mining and geological professionals, with a track-record of successful capital markets achievements. In November 2020, AIS acquired the NSW Yalgogrin Gold Project JV, the Fosterville-Toolleen Gold Project and the Kingston Gold Project in Victoria Australia.

On Behalf of the Board of Directors,

AIS Resources Ltd.

Phillip Thomas, President & CEO

Corporate Contact

For further information, please contact:

Phillip Thomas, Chief Executive Officer

T: +1-747-200-9412

E: pthomas@aisresources.com

Or

Martyn Element. Chairman

T: +1-604-220-6266

E: melement@aisresources.com

Website: www.aisresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ADVISORY: This press release contains forward-looking statements. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The forward-looking statements contained in this press release are made as of the date hereof and the Company undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)