Vancouver, British Columbia – A.I.S. Resources Limited (TSX: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announces that the Company has continued as a British Columbia corporation under the provisions of the Business Corporations Act (British Columbia) (the “BC Act”) and has applied for discontinuance of the Company in the Commonwealth of the Bahamas. The continuance in B.C. (the “Continuance”) will not affect the Company’s status as a listed company on The TSX Venture Exchange or as a reporting issuer under the securities legislation of British Columbia, Alberta and Quebec, and the Company will remain subject to the requirements of such legislation.

As management and the head office of the Company is located in British Columbia, management believes that it will be more efficient and cost-effective for the Company to be governed by the laws of British Columbia. Management also believes that the Continuance will provide the Company with increased opportunities and flexibility in obtaining financing.

The Company was, until recently, subsisting under the Commonwealth of the Bahamas Companies Act, 1992 (No. 18 of 1992), as amended(the “Bahamas Act”). On September 14, 2018 the Company continued its jurisdiction under the Commonwealth of the Bahamas International Business Corporations Actand on December 20, 2018 completed the Continuance under the BC Act. The Company is now subject to the BC Act as through it had been incorporated under the BC Act. Section 305 of the BC Act provides that upon continuance of a foreign corporation as a corporation under the BC Act:

- (a) the BC Act applies to the continued company to the same extent as if the company had been incorporated under the BC Act,

- (b) the continued company has, as its notice of articles, the notice of articles contained in the continuation application,

- (c) the property, rights and interests of the foreign corporation continue to be the property, rights and interests of the continued company,

- (d) the continued company continues to be liable for the obligations of the foreign corporation,

- (e) an existing cause of action, claim or liability to prosecution is unaffected,

- (f) a legal proceeding being prosecuted or pending by or against the foreign corporation may be prosecuted or its prosecution may be continued, as the case may be, by or against the continued company, and

- (g) a conviction against, or a ruling, order or judgment in favour of or against, the foreign corporation may be enforced by or against the continued company.

The Continuance to British Columbia and adoption of the new charter documents has not resulted in any substantive changes to the constitution, powers or management of the Company, except as described below.

Comparison Between the BC Act and the Bahamas Act

The following is a summary only of certain differences between the BC Act, the statute that now governs the corporate affairs of the Company, and the Bahamas Act, the statute which until September 14, 2018 governed the corporate affairs of the Company.

Nothing that follows should be construed as legal advice to any particular shareholder, all of whom are advised to consult their own legal advisors respecting all of the implications of the Continuance.

Charter Documents

Under the BC Act, the charter documents consist of “Notice of Articles”, which sets forth the name of the Company and the amount and type of authorized capital, and “Articles” which govern the management of the Company (collectively, the “Charter Documents”). Under the Bahamas Act, the Company had a “Memorandum of Association”, which, among other things, set forth the name of the Company and the amount and classes of authorized share capital, and “Articles of Association” (collectively, the “Bahamas Articles”) which governed the management of the Company. Upon the Continuance becoming effective, the Bahamas Articles were replaced with the Charter Documents.

The Notice of Articles and Articles under the BC Act provide for authorized capital consisting of unlimited number of common shares without par value and unlimited number of preferred shares without par value, whereas the authorized capital of the Company under the Bahamas Act was $15,000,000 in the currency of the United States of America which could be issued in any combination of common or preferred shares of no par value and convert all of the issued shares to no par value common shares. The attributes of the Common Shares are, in most material respects, similar to the attributes of the common shares previously outstanding under the Bahamas Act. The Preferred Shares may include one or more series and, subject to the BC Act, the directors of the Company may, by resolution, if none of the shares of that particular series are issued, do one or more of the following:

- (a) determine the maximum number of shares of that series that the Company is authorized to issue, determine that there is no such maximum number, or alter any such determination;

- (b) create an identifying name for the shares of that series, or alter any such identifying name; and

- (c) attach special rights or restrictions to the shares of that series, or alter any such special rights or restrictions.

Vote Required for Certain Transactions

Under the BC Act, certain extraordinary corporate actions, such as certain amalgamations, continuations and sales, leases or dispositions of all or substantially all a company’s undertaking other than in the ordinary course of business, and other extraordinary corporate actions such as liquidations, and (if ordered by a court) arrangements, are required to be approved by special resolution. A special resolution is a resolution (i) passed at a meeting by not less than two‐thirds of the votes cast by the shareholders who voted in respect of the resolution, or (ii) approved in writing by all shareholders entitled to vote on the matter.

The Bahamas Act provides for mergers and consolidations, in certain circumstances, and in such case would require, unless otherwise specified in the Articles, consent of an ordinary resolution of shareholders. The Bahamas Act also provides that upon a merger or consolidation, the holders of not less than 90% of the shares may direct the company to redeem the shares held by the remaining shareholders.

Amendments to Corporate Charter

Any substantive change to the corporate charter of a company under the BC Act, such as an alteration of the restrictions, if any, of the business carried on by the Company, a change in the name of the company or an increase or reduction of the authorized capital of the company requires a special resolution passed by not less than two‐thirds of the votes cast by shareholders voting in person or by proxy at a general meeting of the company, unless another type of majority is specified in its Articles. The Company has adopted Articles which alter the requirements for special resolutions in certain instances, as more particularly described below. Other fundamental changes such as an alteration of the special rights and restrictions attached to issued shares, also require a special resolution passed by not less than two‐thirds of the votes cast by the holders of shares of each class entitled to vote at a general meeting of the Company. The holders of all classes of shares adversely affected by an alteration of special rights and restrictions must vote by separate class votes.

As mentioned above, the Articles adopted by the Company provide in Article 10.1 that the following matters may be approved by resolution of the directors:

- (a) the creation of one or more classes or series of shares or, if none of the shares of a class or series of shares are allotted or issued, the elimination that class or series of shares;

- (b) any increase, reduction or elimination of the maximum number of shares that the Company is authorized to issue out of any class or series of shares or establishing a maximum number of shares that the Company is authorized to issue out of any class or series of shares for which no maximum is established;

- (c) the subdivision of all or any of its unissued or fully paid issued shares without par value;

- (d) if the Company is authorized to issue shares of a class of shares with par value:

– (i) decrease the par value of those shares;or

– (ii) if none of the shares of that class of shares are allotted or issued,increase the par value of those shares;

- (e) a change of all or any of its unissued, or fully paid issued, shares with par value into shares without par value or any of its unissued shares without par value into shares with par value;

- (f) the alteration of the identifying name of any of its shares;

- (g) the consolidation of all or any of its unissued, or fully paid issued shares without par value; or

- (h) the alteration otherwise of its shares or authorization of share structure when required or permitted to do so by the BC Act.

Further, Article 10.3 of the Articles to be adopted by the Company permits an alteration to the Company’s Notice of Articles in order to change its name or adopt or change any translation of that name.

Under the Bahamas Act, the Bahamas Articles may be amended by ordinary resolution, which requires the approval of a majority of the votes cast at a meeting (or such greater number as may be specified by the Articles of Association) or approval in writing by all shareholders entitled to vote on the matter. The Board may not effect amendments to the Bahamas Articles on its own.

Dissent Rights

The BC Act provides that shareholders who dissent to certain actions being taken by the Company may exercise a right of dissent and require the Company to purchase the Common Shares held by such shareholder at the fair value of such Common Shares. The dissent right is applicable where any court order permits the dissent or where the Company proposes:

- (a) by resolution to alter the articles to alter restrictions on the powers of the Company or on the business it is permitted to carry on;

- (b) by resolution to adopt an amalgamation agreement;

- (c) by resolution to approve an amalgamation into a foreign jurisdiction;

- (d) by resolution to approve an arrangement, the terms of which arrangement permit dissent;

- (e) by resolution to authorize or ratify the sale, lease or other disposition of all or substantially all of the Company’s undertaking;

- (f) by resolution to authorize the continuation of the Company into a jurisdiction other than British Columbia; or

- (g) to ask shareholders to approve any other resolution, if dissent is authorized by the resolution.

The Bahamas Act provides that shareholders are entitled to payment of the fair value of their share upon dissenting from:

- (a) a merger;

- (b) a consolidation;

- (c) any sale, transfer, lease, exchange or other disposition of more than fifty percent of the value or business of the company in certain circumstances;

- (d) an arrangement, if authorized by the court; and

- (e) redemption by the company following a merger or consolidation.

Oppression Remedies

Under the BC Act, a shareholder, or any other person whom the court considers to be an appropriate person to make an application, has the right to apply to court on the grounds that:

- (a) the affairs of the Company are being or have been conducted, or that the powers of the directors are being or have been exercised, in a manner oppressive to one or more of the shareholders, including the applicant, or

- (b) some act of the Company has been done or is threatened, or that some resolution of the shareholders or of the shareholders holding shares of a class or series of shares has been passed or is proposed, that is unfairly prejudicial to one or more of the shareholders, including the applicant.

On such an application, the court may make such order as it sees fit including an order to prohibit any act proposed by the Company.

The Bahamas Act does not provide for a similar remedy.

Derivative Action

Under the BC Act, a shareholder or director of the Company may, with leave of the court, prosecute a legal proceeding in the name and on behalf of the Company to enforce a right, duty or obligation owed to the Company that could be enforced by the Company itself or to obtain damages for any breach of such a right, duty or obligation.

The Bahamas courts have recognized derivative suits by shareholders in some limited circumstances. The Bahamas courts ordinarily would be expected to follow English precedent, which would permit a minority shareholder to commence an action against or a derivative action in the name of the company only:

- (a) where the act complained of is alleged to be beyond the corporate power of the company or illegal;

- (b) where the act complained of is alleged to constitute a fraud against the minority perpetrated by those in control of the company;

- (c) where the act requires approval by a greater percentage of the company’s shareholders than actually approved it; or

- (d) where there is an absolute necessity to waive the general rule that a shareholder may not bring such an action in order that there not be a denial of justice or a violation of the company’s memorandum of association.

Duties of Directors and Officers

Under the BC Act, in exercising their powers and discharging their duties, directors and officers must act honestly and in good faith, with a view to the best interests of the Company and exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances. No provision in the corporation’s notice of articles, articles, resolutions or contracts can relieve a director or officer of these duties.

Fiduciary obligations of directors under Bahamas Act are substantially the same as under the BC Act. The Bahamas Act does not directly address the issue of the limitation of a director’s liability, however, Bahamas public policy will not allow the limitation of a director’s liability for his or her own fraud, willful neglect or willful default. In addition, the Bahamas courts would be expected to follow English precedent in respect of fiduciary duties of the directors and officers of a company.

Indemnification of Officers and Directors

The BC Act allows a corporation to indemnify a director or former director or officer or former officer of a corporation or its affiliates against all liability and expenses reasonably incurred by him in a proceeding to which he is made party by reason of being or having been a director or officer if he acted honestly and in good faith with a view to the best interests of the corporation and, in cases where an action is or was substantially successful on the merits of his defence of the action or proceeding against him in his capacity as a director or officer.

Under the Bahamas Act a company may provide for the indemnification of its directors, officers, employees and agents if he acted honestly and in good faith with a view to the best interests of the corporation and, in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, had reasonable grounds for believing that his conduct was lawful.

Income Tax Considerations

Shareholders should consult their own tax advisers with respect to the income tax consequences to them of the Continuance under federal, provincial, territorial and other applicable tax legislation.

About A.I.S. Resources

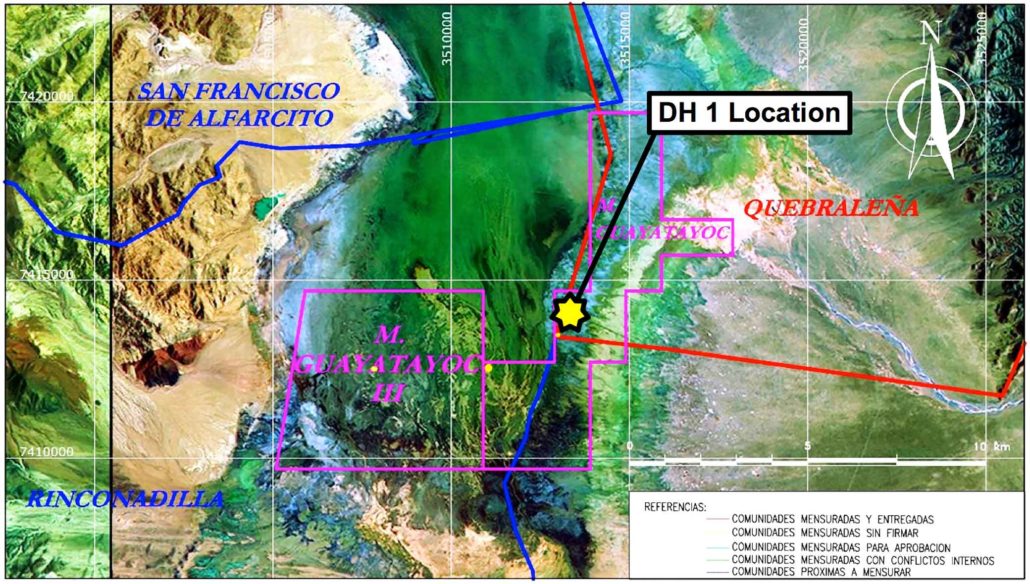

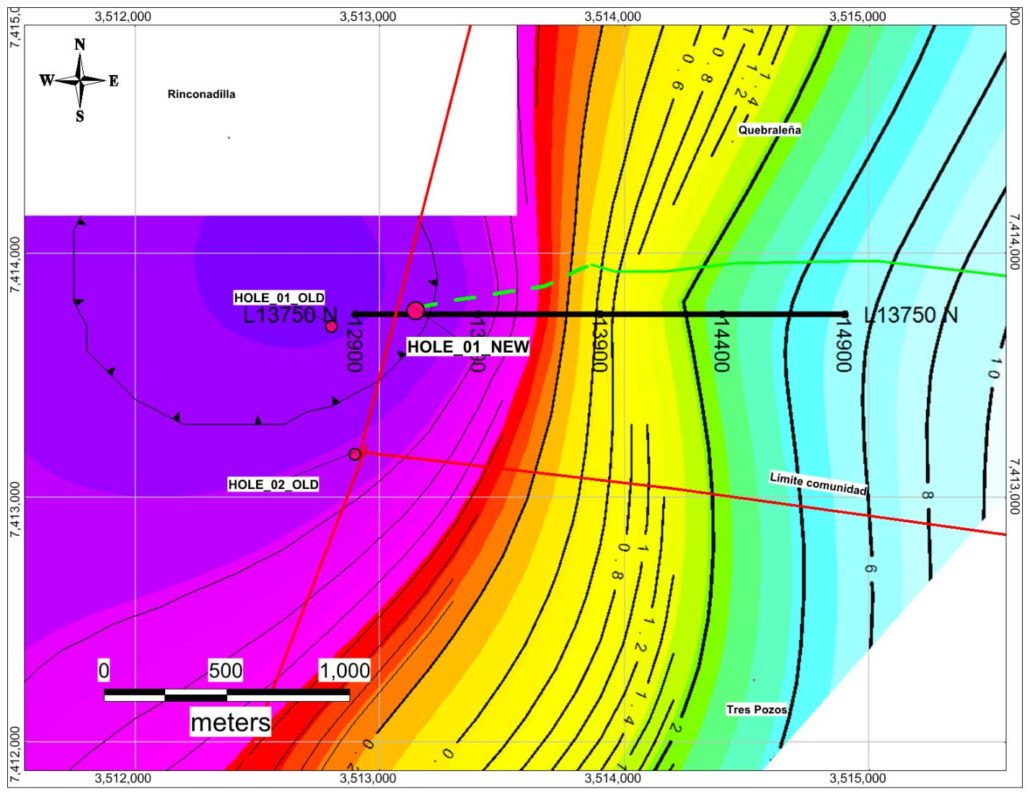

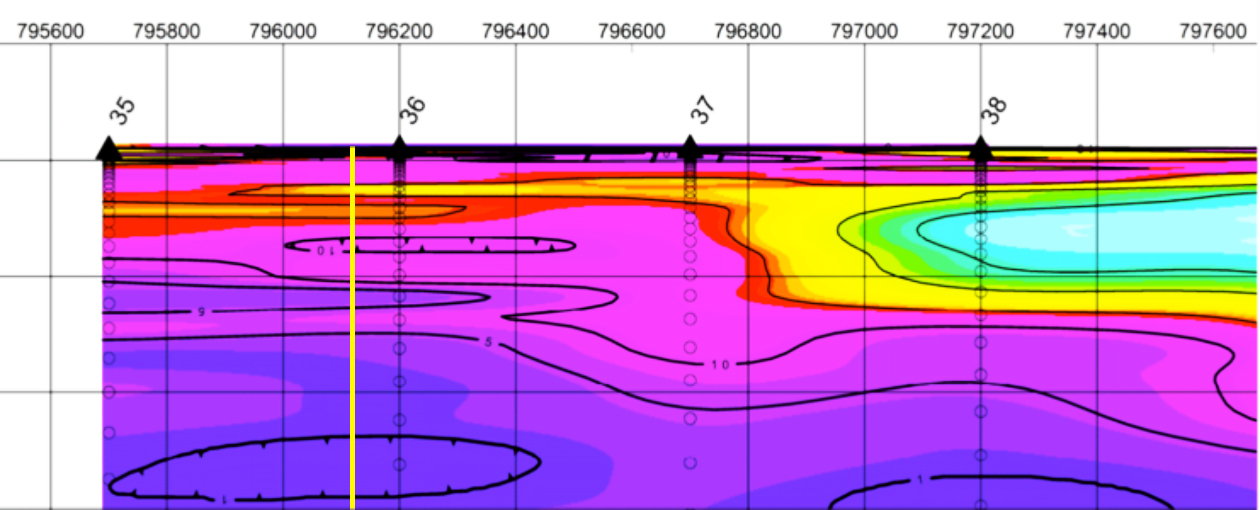

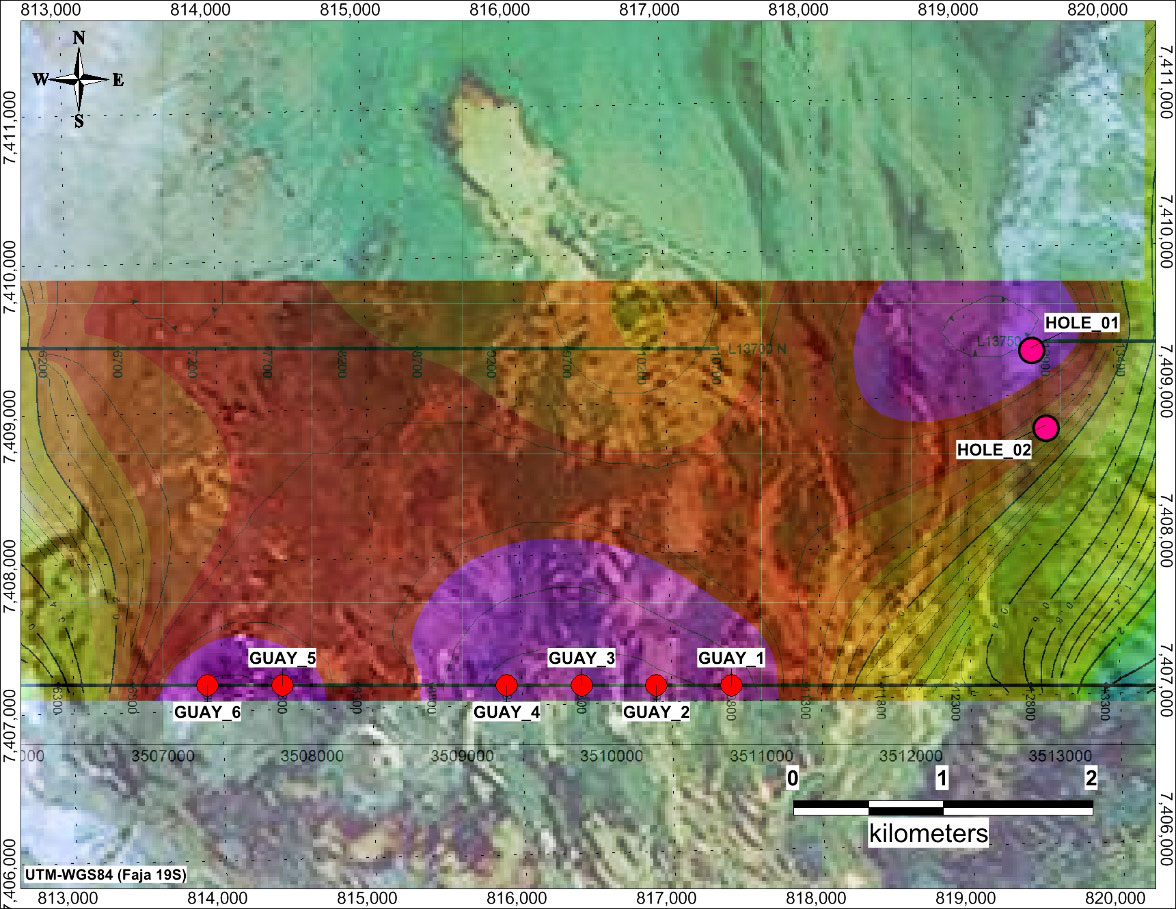

A.I.S. Resources Ltd. is a TSX-V listed investment issuer, was established in 1967 and is managed by experienced, highly qualified professionals who have a long track record of success in lithium exploration, production and capital markets. Through their extensive business and scientific networks, they identify and develop projects worldwide that have strong potential for growth with the objective of providing significant returns for shareholders. The Company’s current activities are focused on the exploration and development of lithium brine projects in northern Argentina.

On Behalf of the Board of Directors,

AIS Resources Ltd.

Phillip Thomas, President & CEO

Corporate Contact

Phillip Thomas

President & CEO

T: 747 200 9412

E: pthomas@aisresources.com

Martyn Element

Chairman

T: 604 687 6820

E: melement@aisresources.com

Website: www.aisresources.com

ADVISORY: This press release contains forward-looking statements. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)