A.I.S. Resources Announces Drill Permit Issued for Guayatayoc Mina, Argentina

Vancouver, British Columbia – A.I.S. Resources Limited (TSX: AIS, OTCQB: AISSF) (the “Company” or “AIS”) is pleased to announce that it has been issued with a seismic and drilling exploration permit for Guayatayoc Mina. It is expected that the permit for Guayatayoc III will also be issued shortly.

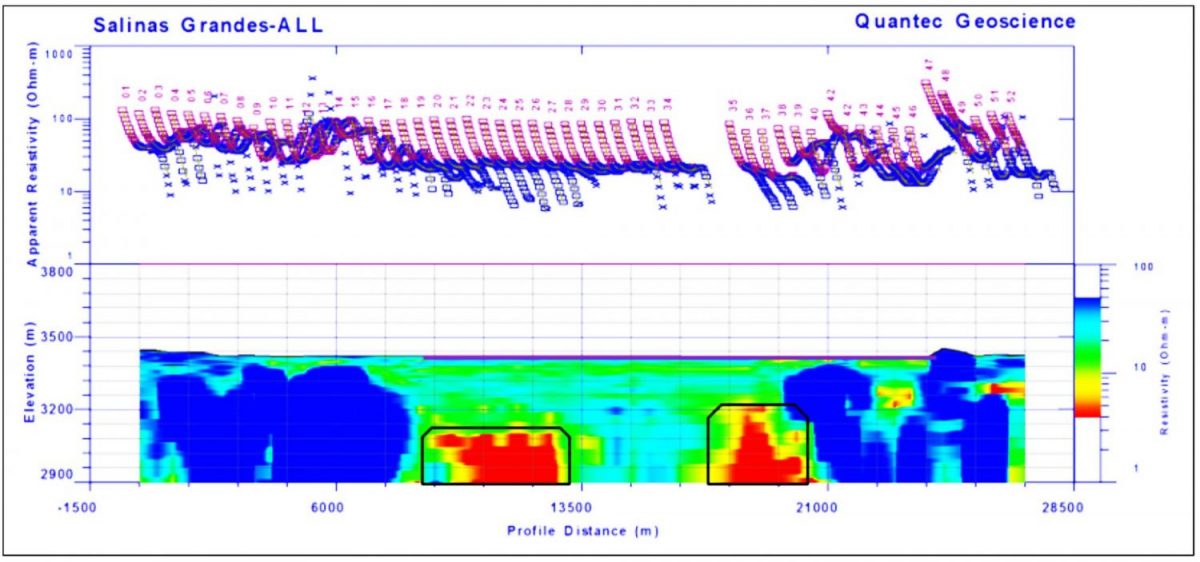

Detailed discussions with Quantec have been undertaken with regards to a TEM survey and results will be available shortly, subject to inhouse analysis and interpretation.

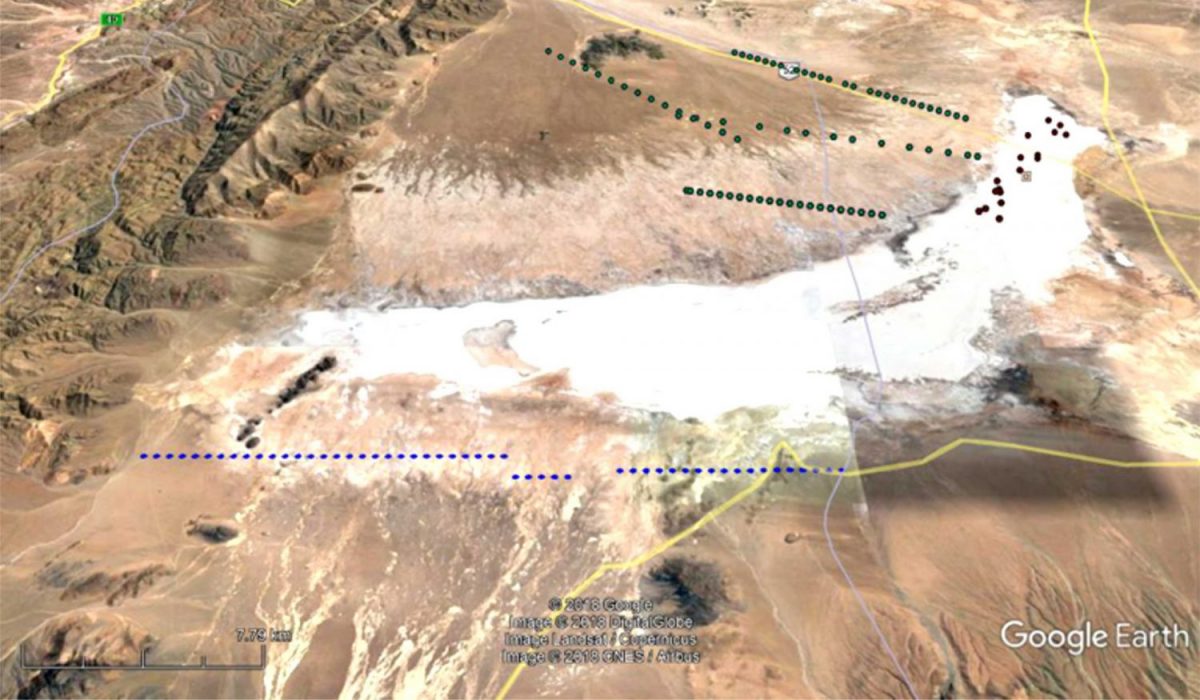

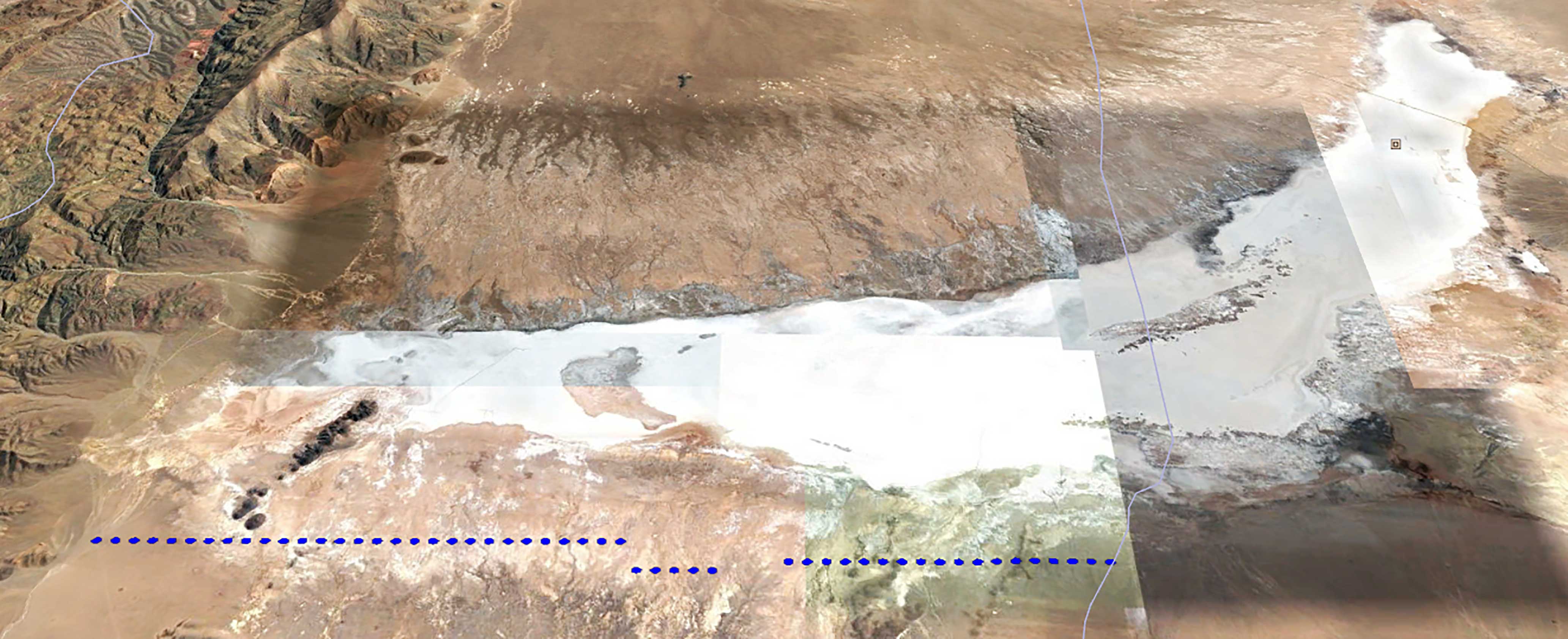

We are planning a two-hole drill program, and shortly drill pads, roads and drill fluid pits will be ar-ranged. It is anticipated that the drill program will commence in four weeks or earlier. The depth of each drill hole will be 400 metres. A baseline environmental study will be completed prior to the drilling activities. Sampling of water and soils will commence next week.

Phillip Thomas, CEO and Exploration Director commented, “This is a great outcome after two years of work with the communities and the government of Jujuy, particularly the Mines Department in Jujuy. The relationships we have developed will assist us in other initiatives we have planned for. Positive drill results will have a significant effect on the Company’s future.”

Qualified Person

Phillip Thomas, BSc Geol, MBusM, MAIG, MAIMVA, (CMV), a qualified person as defined under National Instrument 43-101 regulations, has reviewed the technical information that forms part of this news re-lease, and has approved the disclosure herein. Mr. Thomas is not independent of the company as he is a Chief Executive Officer and shareholder.

About A.I.S. Resources

A.I.S. Resources Ltd. is a TSX listed investment issuer, was established in 1967 and is managed by experi-enced, highly qualified professionals, who have a long track record of success in lithium exploration, production and capital markets. Through their extensive business and scientific networks, they identify and develop high economic probability projects worldwide, that have strong potential for growth with the objective of providing significant returns for shareholders. The Company’s current activities are fo-cused exclusively on the exploration and development of lithium brine projects in northern Argentina. It is currently exploring the Guayatayoc and Salinas Grandes salars.

On Behalf of the Board of Directors,

AIS Resources Ltd.

Phillip Thomas, President & CEO

Corporate Contact

Phillip Thomas

President & CEO

T: 747 200 9412

E: pthomas@aisresources.com

Martyn Element

Chairman

T: 604 687 6820

E: melement@aisresources.com

Website: www.aisresources.com

ADVISORY: This press release contains forward-looking statements. More particularly, this press release contains statements concerning the anticipated use of the proceeds of the Private Placement. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The intended use of the proceeds of the Private Placement by the Corporation might change if the board of directors of the Corporation determines that it would be in the best interests of the Corporation to deploy the proceeds for some other purpose. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)