A.I.S. Resources COO Phillip Thomas Talks With Matt Bohlsen of Trend Investing

Phillip Thomas is Chief Operating Officer and Geologist of AIS Resources Ltd TSXV:AIS and OTCQB:AISSF

Phillip Thomas is Chief Operating Officer and Geologist of AIS Resources Ltd TSXV:AIS and OTCQB:AISSF

A.I.S Resources Limited a TSX-V listed investment issuer, was established in 1967 and is managed by experienced, highly qualified professionals who have a long track record of success in lithium exploration and production and the capital markets. Through their extensive business and scientific network, they identify and develop early stage projects worldwide that have strong potential for growth with the objective of providing significant returns for shareholders.

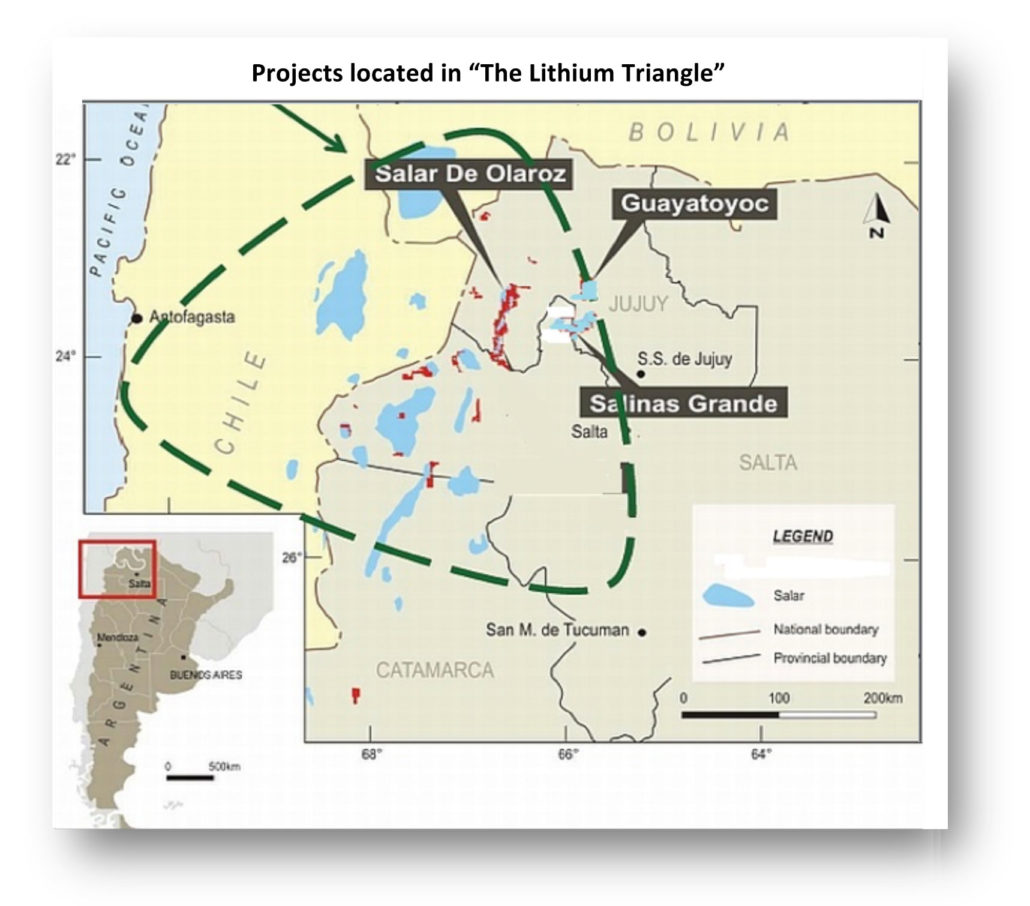

Phillip Thomas, BSc Geol, MBusM, MAIG, MAIMVA, (CMV) has spent the past 12 years exploring for lithium brines, building and operating lithium carbonate pilot and production plants, and building production and processing facilities. He has firsthand experience with the highly technical process of operating a lithium carbonate/lithium chloride plant at the Rincon salar. He was Chairman and CEO of Admiralty Resources from 2004 to 2008, where he and his team explored the Rincon and other salars and built the lithium carbonate processing facility which commenced operation in 2007. Upon the sale to the Sentient group in 2008, he resigned to pursue other lithium development opportunities. He and this team developed the Pozuelos salar producing an indicated and inferred resource, and putting in two production wells. They also put together a fully equipped lab and pilot plant in Salta to manage the extraction processes and phase chemistry including fractional crystallization, membranes and ion exchange processes. At Hombre Muerto salar they trenched, drilled and constructed lithium isobars. Most recently he’s been involved in exploring the Pocitos, Salinas Grandes and Guayatayoc salars. He is an experienced lithium brine Geologist both in the field and has written bankable feasibility studies and proven and probable reserve estimate statements. Has significant investment banking experience holding senior executive/director roles with Macquarie Bank, ABN-Amro, McIntosh Securities and actuaries Watson Wyatt.

What are your current views on the lithium industry? Can you please give your views on supply and demand issues, industry consolidation, and on current and future lithium pricing?

The current spot market for lithium carbonate above 99.2% is very strong. I saw a recent tender at $21,800 per tonne. As far as production goes, no-one has declared letting a procurement, engineering, construction contract (including us) so there is a lead time of approximately two years to reach production. There are processing technologies being experimented with at lab bench scale but it’s a long road to commercial production. To date no-one has proved a more streamlined solution being economically competitive than ion exchange and fractional crystallization which is what we have proved. Lithium Oxide production is expanding rapidly and this will probably be the next major source of lithium carbonate and lithium hydroxide, but at a price premium. However there are nine gigafactories building six different types of battery technologies, and given this I expect the market to be in deficit for at least five years if not longer. In Norway 52% of new car sales were hybrids or EV and I think this is a trend that will permeate Europe. China also has its own incentives for hybrids and EV’s. High electric density batteries are absolutely required for these cars and the best technology to date is the cobalt manganese lithium battery. The 27,000 electric buses in China use a lower grade battery but they are also big consumers of lithium carbonate to build these batteries. Carbon/Iron batteries were developed on the lab bench recently and they promise to drop the price, and increase electric density. However, this will take quite a few years but it’s a trend.

Glencore, commissioned CRU to conduct research into what 30 million sales of EVs by 2030 would mean. “As early as 2020, forecast EV related metal demand is becoming material, requiring an additional circa 390,000 tonnes of copper, circa 85,000 tonnes of nickel and 24,000 tonnes of cobalt,’’ Glencore’s investor presentation said. That implies more than 100,000 tonnes of lithium carbonate at a high grade will be required annually.

The industry will consolidate very quickly as in Argentina not many junior explorers have the skill, expertise and processing skill to produce lithium carbonate or lithium hydroxide at a low price. The are no phase chemistry diagrams for lithium, sodium, magnesium, calcium that have been published that operate in a high saline environment. This is a major hurdle. In Chile it is at the behest of the government policy and what protection mechanisms the politicians put in place to protect SQM. Lithium was considered a strategic metal in Chile and the government has held production licences very closely. I don’t think this situation will be resolved in a commercial sense for quite a few years. I have worked in Chile since 2004 and have a sense of the politics.

What is AIS Resources currently working on in regards to your flagship Guayatayoc lithium project and what stage are you at? When do you expect to announce a compliant resource estimate and complete your BFS? Please include any off-take partner discussions.

As you know we have two projects Guayatayoc and Chiron. Guayatayoc is waiting for the final UGAMP meeting in early first quarter 2018, and then we expect our drilling permit to be issued, the first one ever issued in Jujuy province we think. Dr Solar who is head of the Mines department has been very helpful. The government has been working closely with all 23 provinces to ensure the Macri goals of developing Argentinas natural resources is achieved. Morales who is the Govenor of Jujuy is also keen to see progress quickly to encourage employment and revenues. We have some superb 2D seismic data and interpretation from Dr Steinmetz PhD thesis from 1995 till recent analysis. Then we have Steinmetz and Galli’s work in 2015 which ties in the stratigraphic, tectonic, basin development and dating information in Guayatayoc and Salinas Grandes. So once we get our drilling permit we will produce an inferred and indicated mineral resource statement, and once production testing is completed a measured mineral resource statement followed by a proven and probable reserve statement and the banking feasibility study. A US$2m budget has been set for this work including drilling and the VES seismic work which needs to be completed.

At Chiron we have our seismic and drilling permits so we will be starting seismic on 10th January and probably 8 drill holes of about 3,200 metres in total and then produce a inferred and indicated mineral resource estimate.

Regarding takeoff contracts we have been having discussions with a number of parties in China, Taiwan, Japan, Korea and Europe. One party has been to Guayatayoc and inspected the property and our laboratory facilities. We also have been producing samples and have a a few kilos of greater than 99.2% and 99.6% Lithium Carbonate. Later in the year we will target the LPF6 producers, the gigafactories and others. We have been approached by a number of brokers as well. To fund the project we have designed a virtual equity style contract which will enable us to use the credit of the takeoff contract with the debt/equity piece. The cost of the 8,000 tonne per annum project is estimated at “C Class” to be just under US$100m.

What do you see as the main catalysts for AIS Resources going forward, and where do you see your company being in one and in five years? What are your production targets (I read a target of 8,000tpa LCE) for Guayatayoc? Can investors expect to see a higher target going forward, perhaps 16-20,000tpa?

We have a detailed Gantt chart month by month in our presentation, but we expect over the next twelve months to get to the point of having a Proven and Probable mineral reserve statement, a bankable feasibility study, completed engineering, procurement and construction contracts and drawings and permitting to complete pond construction. In 2019 we expect construction to be completed and the brines in some of the ponds ready to process in the commissioning stage. Depending on the grade of lithium brines we pump, which is set at about 300ppm at the moment we will get 8,000 tonnes a year. If we get 400ppm we will get close to 11,000 tonnes a year. For this we need to pump about 700 litres of brine per minute which should be easy out of three production wells that are close to 200 metres deep. That’s just 233 litres per well per minute. All you need to do is dig a 2 metre deep hole and the brine fills it in 10-15 minutes, so we expect the hydrostatic pressure to be much greater at depth.

In five years we will hopefully have our clients requesting 20-25,000 tonnes a year and we would have expanded the processing foot print. The nice thing about our process is its modular and easily expandable. The plant footprint will be built to 16,000 tonnes but we will only put 8,000 tonne of processing gear in. That’s our concept at this stage but its going to be an interesting 12 months.

Do you think AIS Resources is currently fairly valued, undervalued or overvalued by the market? Where do you see your company and the stock price being in 5 years?

Being a Certified Mineral Valuer and having twelve years experience as a stockbroker and fund manager I’m not sure where to start. Its clear we have some risks in terms of permitting and locating drill holes on Guayatayoc to produce 700 litres per minute of brine. This risk is a hydrogeological risk, because we know the brine is there. It’s a matter of locating the best production holes. So say we get it totally wrong and have to drill another 14 holes its going to be a $700,000 risk. However given the huge amount of data we have and more than 20 man years studying the basin this is unlikely to eventuate. My view is the market hasn’t priced in our ability to develop the project quickly. So we are lagging other explorers.

You don’t have to be a maths genius to work out that if we have 100 million shares on issue and an economic value of $60 million, and a margin contribution of $100,000,000 at $10,000 per tonne (being $1 per share) using a price earnings index of 10 times you get $10 per share. However there are much more rigorous methods of computing the lower and upper quartile share market ranges and I would encourage your readers to go to www.aimva.com.au to look at some of the data and methods on this website of the Australasian Institute of Mineral Valuers and Appraisers.

Could you please comment on AIS Resources other lithium projects such as Vilama and Quinos Salar, and any other acquisition and your processing plant plans?

We were very excited when we sampled Vilama because of the great values of lithium on the surface, good ratios of lithium to magnesium, the flat terrain, the absence of wild life and the proximity to the volcanic chain that runs along the Argentina/Chile/Bolivia border which is about 5 kilometres away. It was initially a struggle breathing at 4,500 metres but we got used to it. The salar is located close to another salar but the road needs extensive refurbishment on the Argentina side between it and Susques a major town about 100km away. On the Chile side the government is actively renovating the road which we saw when we last visited. At this stage we have our hands full with Chiron (Quinos salar) and Guayatayoc so we will complete the seismic then the drilling at Chiron. Then we will be able to estimate how much brine we can contribute to the Guayatayoc plant. Guayatayoc has gas, 240v and 415v electricity, labour only 30km away and existing fresh water spring 3 km from the road.

Would you like to add anything that you think investors should know about AIS Resources?

Our team is working hard on permitting, exploration, mineral brine estimates, feasibility studies, phase chemistry and processing technology all at once. We are not doing it in a sequential manner. Therefore I think we are way in front of most junior explorers as they haven’t started some of the pieces we have already completed as they are approaching it as sequential process like a copper mine. The talent we have on board have deep experience, highly educated, and have got their hands dirty doing the work two or three times, which counts for a lot. There are countless examples of explorers claiming processes that didn’t work, or copying patents that don’t work in a commercial setting. The fact lithium can change its valency in different chemical settings is one small example of some of the issues to contend with. Many business development/investor relations people have no concept of the difficulty and complexity and unless you have been in the CEO role you tend to underestimate the challenges.

Our lithium production will be tailored to the market we can dominate, and the grade is as important as the lack of deleterious impurities and we will focus on this. Back in 2007 we did an ISO17045 audit and held certification for ISO and we will do this again. Dr Carlos Sorentino, our chemical engineer has made a significant contribution and I believe he is one of the very few people who truly understand this business at the level required to produce successfully. Having access to a laboratory, and pilot plant has made our task much easier and saved us many months of testing.

Investors can view the latest company presentation here.

Disclosure: I am/we are long AIS Resources (TSXV:AIS). I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)