Dudley Pierce Baker’s Junior Mining News – The Lithium Boom Has a New Player in Argentina

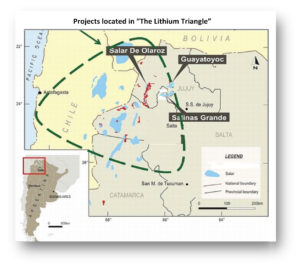

The primary project consists of a 7500 ha property at Guayatayoc located in the center of lithium production in Argentina. Prior work on the project was for the production of borates; however, samples were taken showing a good grade of lithium. The project was approved for mining borates and the Argentine government has just allowed lithium to be added to the existing mining license.

This company is a zero brainer. They have right at 19 million shares outstanding with a price of about $0.40 a share. So call it slightly below $8 million market cap. There are literally dozens of companies out there in the lithium space with moose pasture, no hope of ever getting a mining license and market caps ten times higher than AIS.

AIS has hit the ground running. Having a mining license in hand is giant. There has been 2D Seismic done on the project and identified where the aquifers are. They are starting a pit sampling program drilling down four to five meters on a 500-meter to 1,000-meter grid. Once complete the company will do infill pits on a 100-meter to 250-meter spacing to increase the quality of the resource.

The company just added an extremely qualified lithium guy who developed two major lithium projects in Argentina and was active in three lithium projects in the last four years. The Director, Phillip Thomas, worked on the Rincom salar project in Argentina and prepared the bankable feasibility study for the property. He is one of the most experienced and top guys in the lithium field in South America and especially Argentina.

AIS is paying $150,000 USD for a six-month option on the project and there is a further US$4.5 million due at the completion of scientific studies and exploration for a 100% interest.

There are probably seventy-eighty different Canadian juniors all claiming to be the best investment in lithium. Most of them are scams and will never see production. The market believes there will be a lithium shortage through 2025 but at some point the market will be saturated. Lithium is common. It’s not the biggest project or even the best project that will cross the finish line, it’s the few who can get permitted and into production soonest that will reward shareholders.

Prior exploration showed lithium values between 200 and 800 ppm. That is considered highly economic. Magnesium to lithium ratios are less than 4-1; excellent for low cost processing.

AIS is not an advertiser. I have participated in a private placement based on knowing senior management from past deals. I think they have a home run, they certainly have one of the most qualified technical teams I have seen and they have a mining permit. That will be golden. Please do your own due diligence.

A.I.S. Resources Ltd.

AIS.H-V $0.40 (Nov 01, 2016) />

19.2 million shares

A.I.S website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: SolGold plc and A.I.S. Resources Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company does not have a financial relationship with any of the companies mentioned in this article. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

( Companies Mentioned: AIS.H:TSX.V, SOLG:AIM)

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)