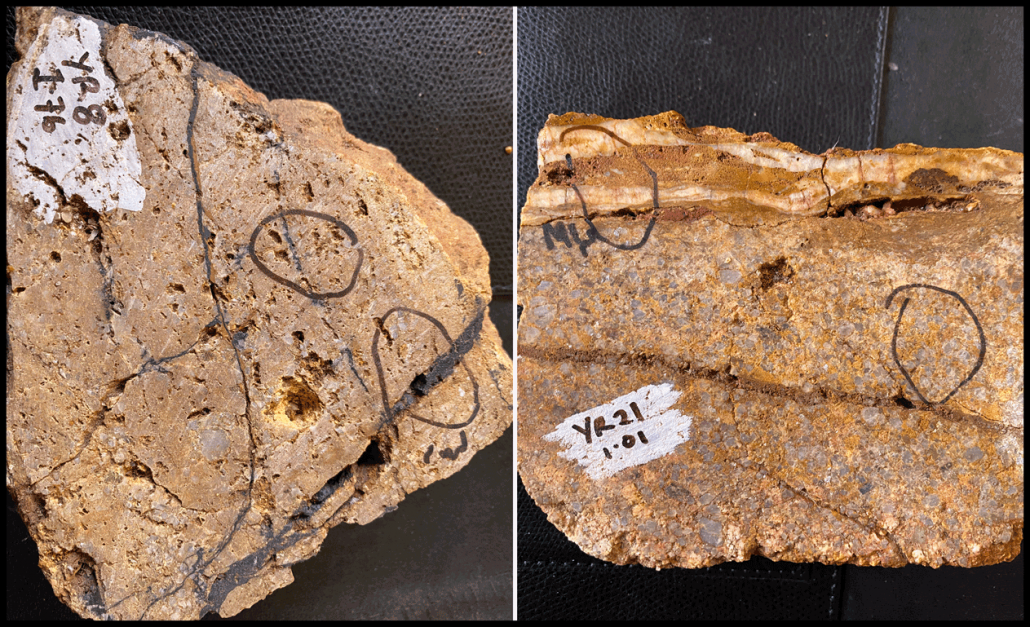

Vancouver, British Columbia – A.I.S. Resources Limited (TSX: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announces that on July 17, 2020 the Company entered into a binding letter of intent (“LOI”), to acquire the Yalgogrin orogenic gold project (the “Project”), with Auger results of 12.5 gm/t and 32.3 gm/t, and 14 DDH’s with intercepts ranging from 1.9 gm/t to 1m at 21.5 gm/t. The Project is located in the historic West Wyalong gold corridor of central NSW, Australia which produced 445,700 oz gold mined between 1894-1921. Denis Walsh, the vendor, is a senior consulting geologist at the Victoria Fosterville gold mine. AIS will acquire two exploration licences (ELs) the EL5891 tenement, which is 2.8 sq. km. (280 ha) and the EL6030, which is 56 sq. km. and encompasses two historical gold mines.

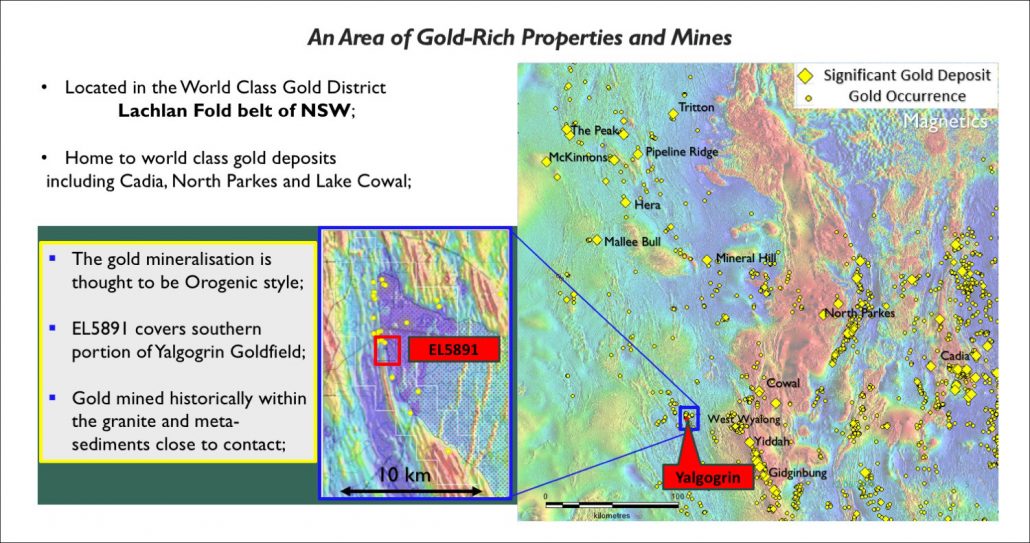

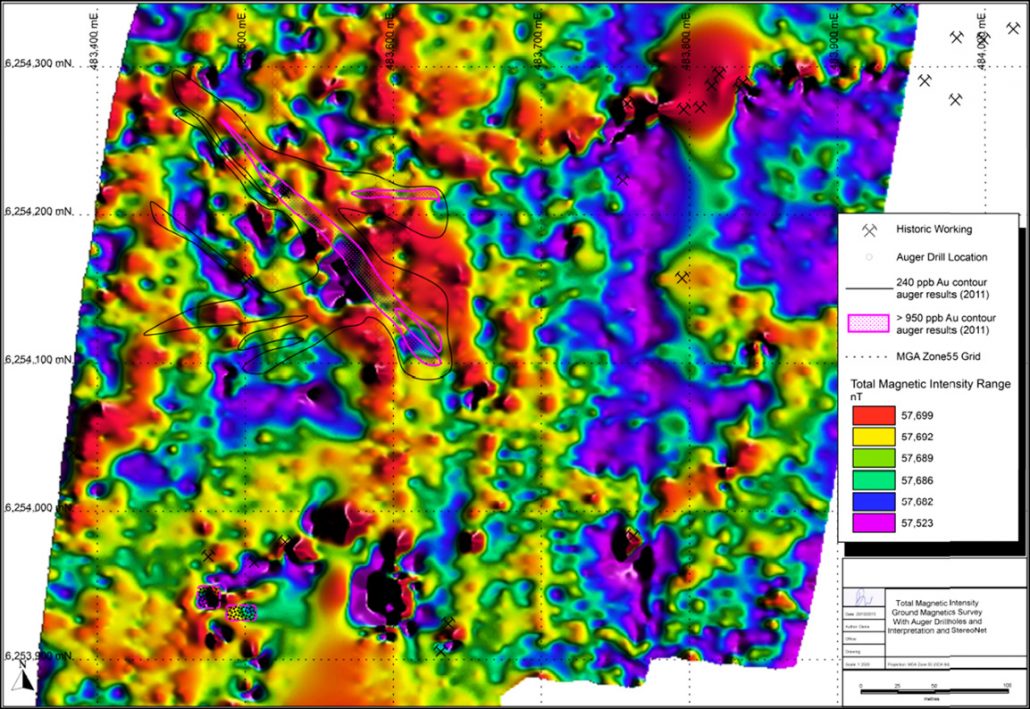

Fig 1. Regional magnetic survey

Fig 1. Regional magnetic survey

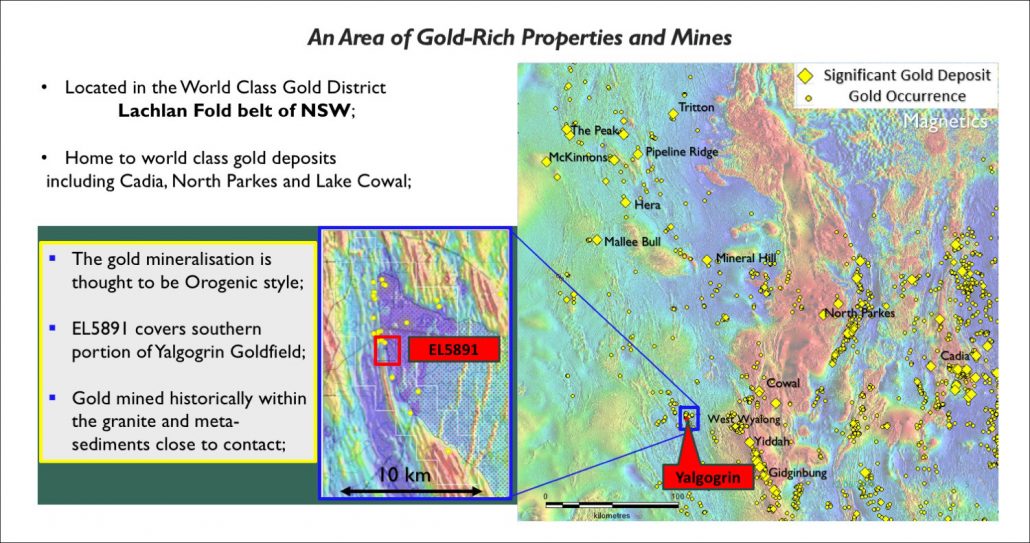

Located approximately 37 km. west of the town of West Wyalong on the Newell Highway and 595 km. north of Melbourne, this advanced-stage exploration project is in the Lachlan Fold Belt of NSW in the historic Yalgogrin goldfield. Thisregion has seen significant gold mining over the past 100 years and currently has three major operating gold projects:

- Cadia Newcrest 220 km north west producing 900,000 oz of gold a year,

- Lake Cowal Gold Mine which is 40 km from Yalgogrin project, that was purchased by Evolution for $550 million, and

- North Parkes, a copper and gold mine 168 km to the northeast thatin 25 years has produced 1.464 million ounces of gold and 1.168 million tonnes of copper.

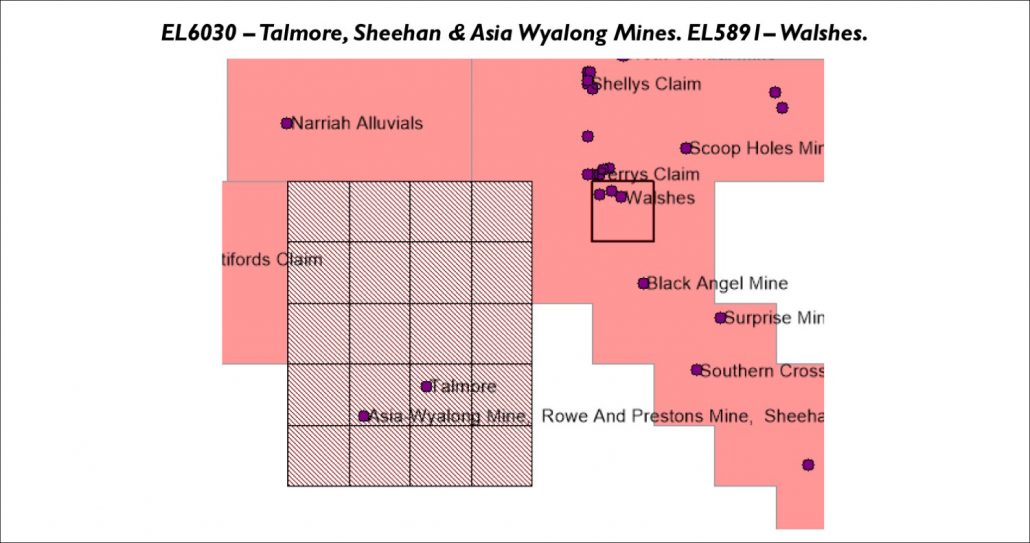

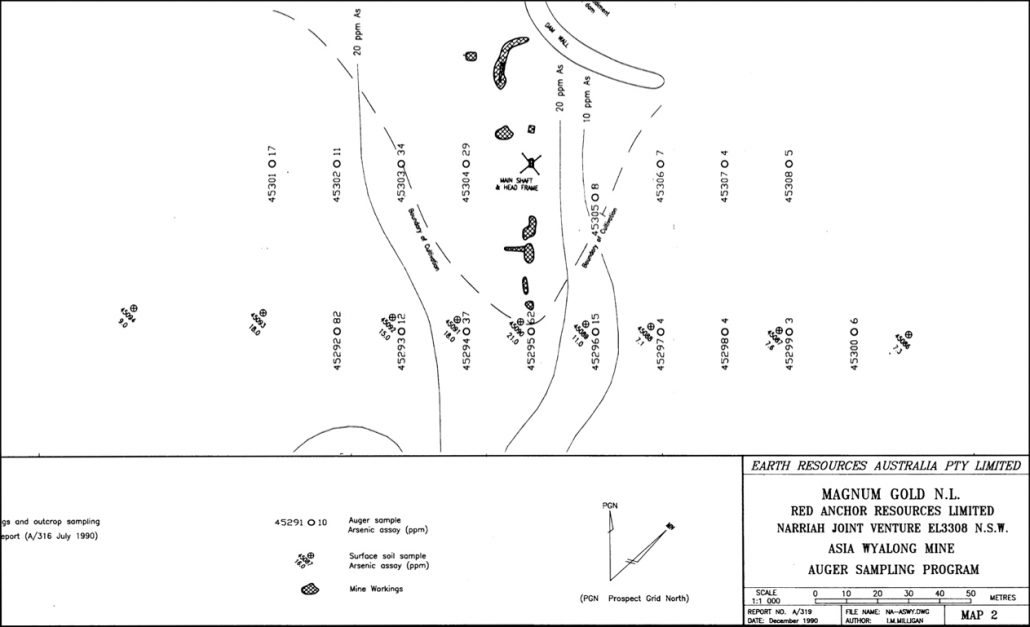

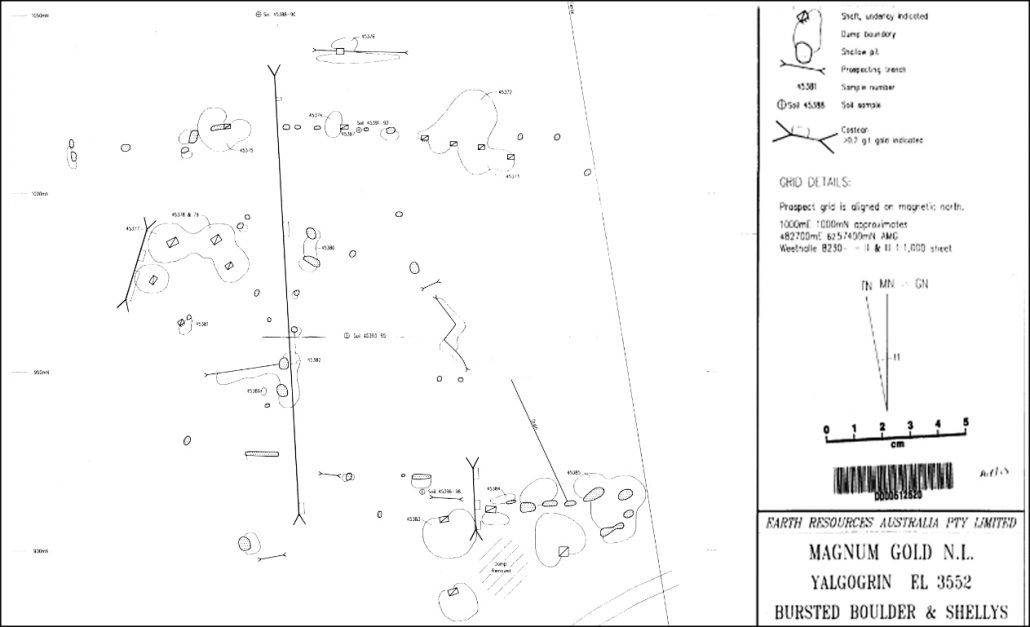

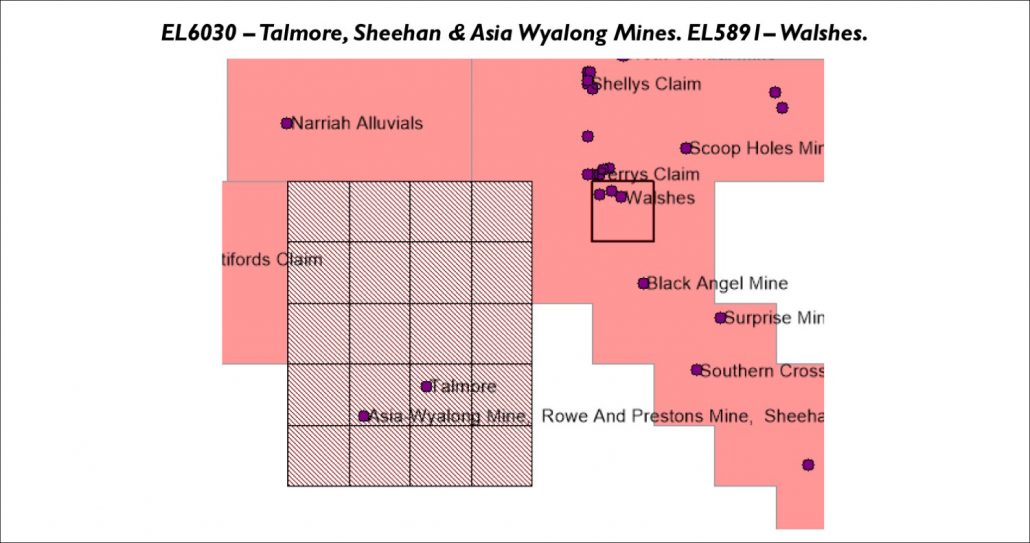

Fig 2. EL6030 covers 56 sq. km. including the Talmore, Sheehan and Asia Wyalong mines, and EL5891 covers the Walshes.

Fig 2. EL6030 covers 56 sq. km. including the Talmore, Sheehan and Asia Wyalong mines, and EL5891 covers the Walshes.

Thomson Resources Ltd (ASX:TMZ) has staked around the EL5891 tenement completely.

Local Geology

The local geological environment is a magnetic, magmatic complex of Ordovician age located within the Lachlan Fold Belt. Numerous gold deposits occur in the West Wyalong Temora Adelong district, many of them close to the Gilmore Suture, which is delineated by regional aeromagnetic and gravity data. A sequence of Late Ordovician metasediments, which have been intruded by granites of (mostly) Silurian age is situated to the west of the suture. To the east of the suture, Ordovician metasediment strata form basement to an extensive sequence of volcanics and sediments which have been intruded by granitic dioritic, and gabbroic bodies of (mostly) Early Devonian age.

Granodiorite phases of the Siluro-Devonian batholiths are the host to, or were the source of substantial primary and secondary gold mineralisation at Adelong, West Wyalong, and Sebastopol-Junee Reefs (some orebodies) along the Gilmore Fault Zone.

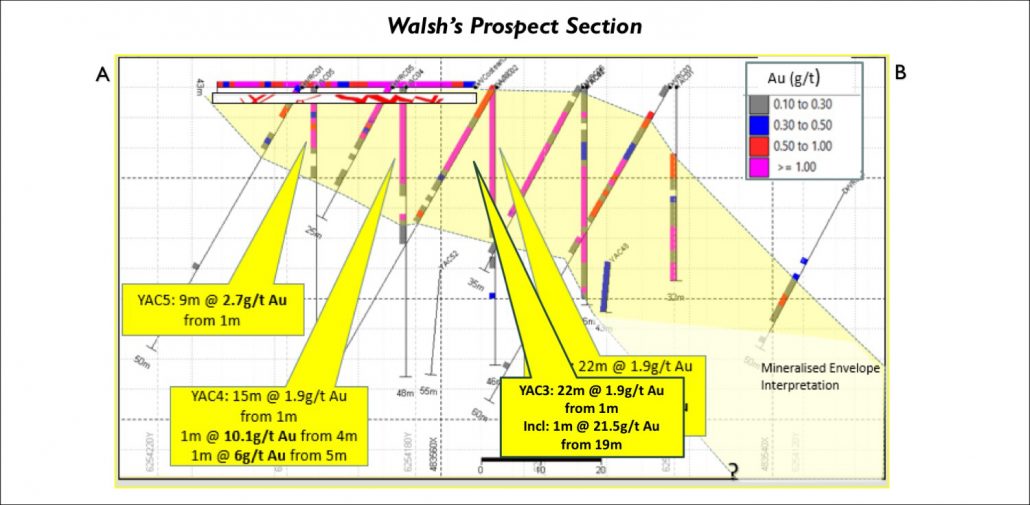

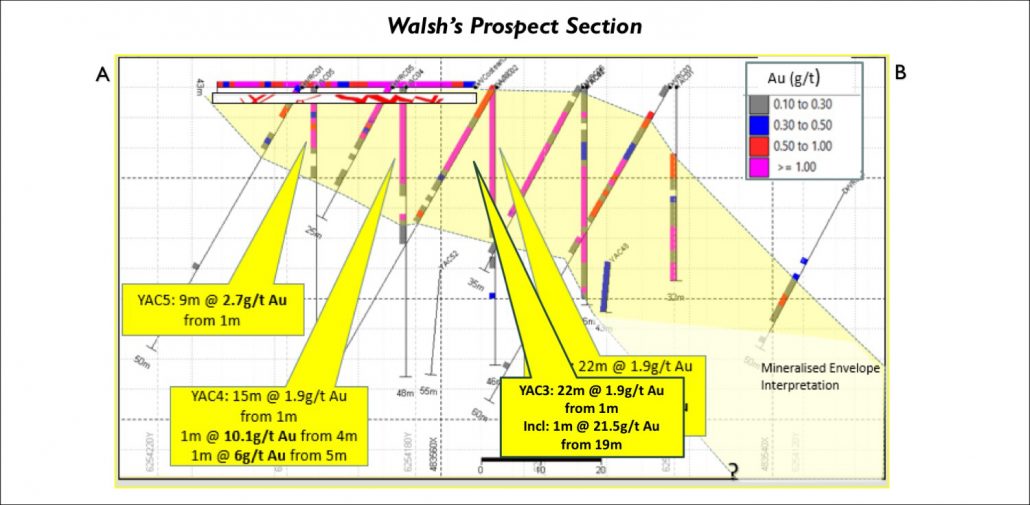

Fig 3. Geological Model from Drill hole data on the tenement.

Fig 3. Geological Model from Drill hole data on the tenement.

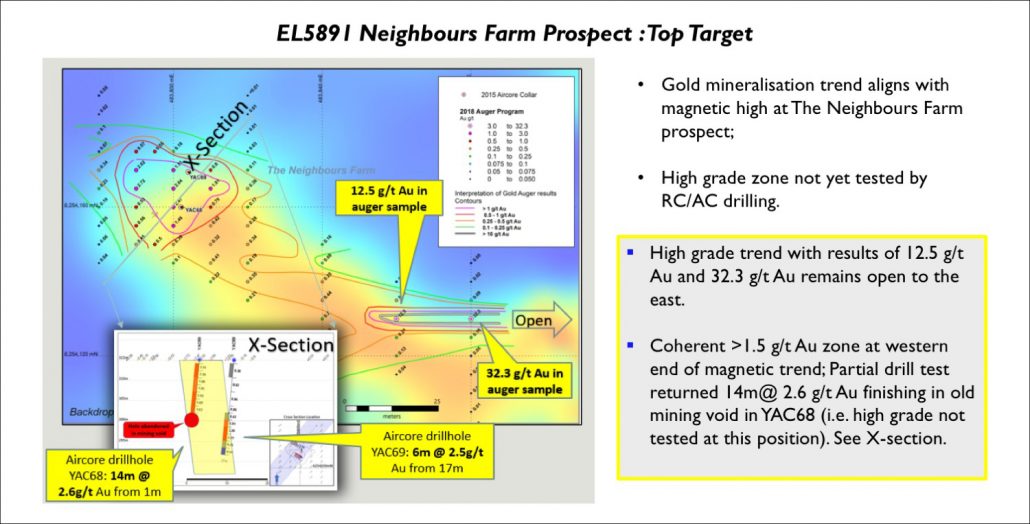

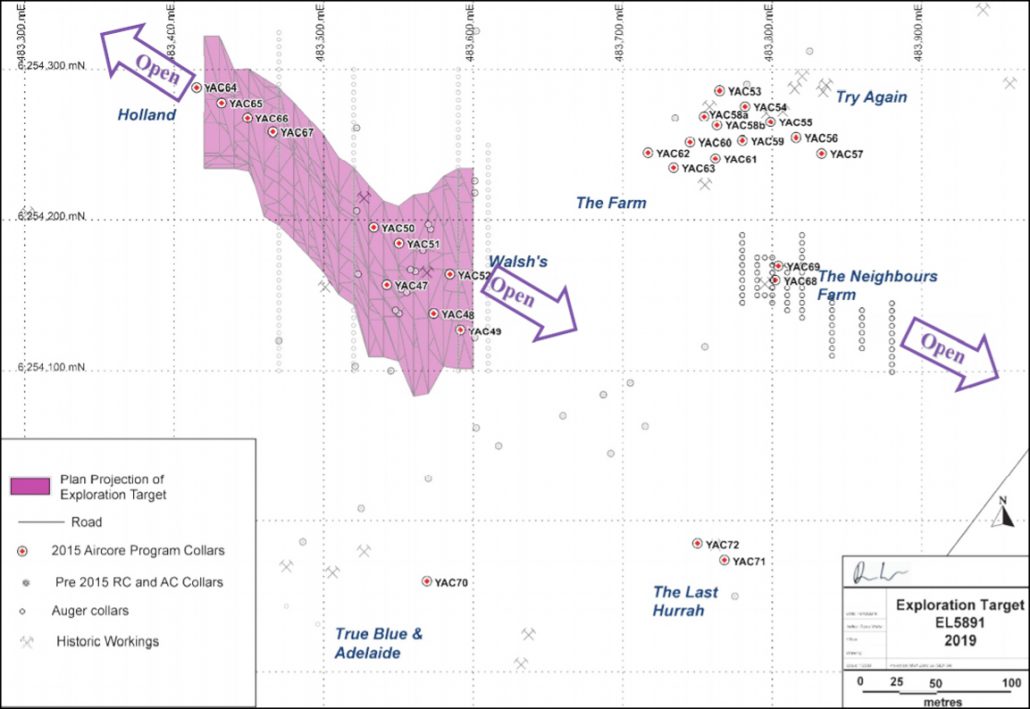

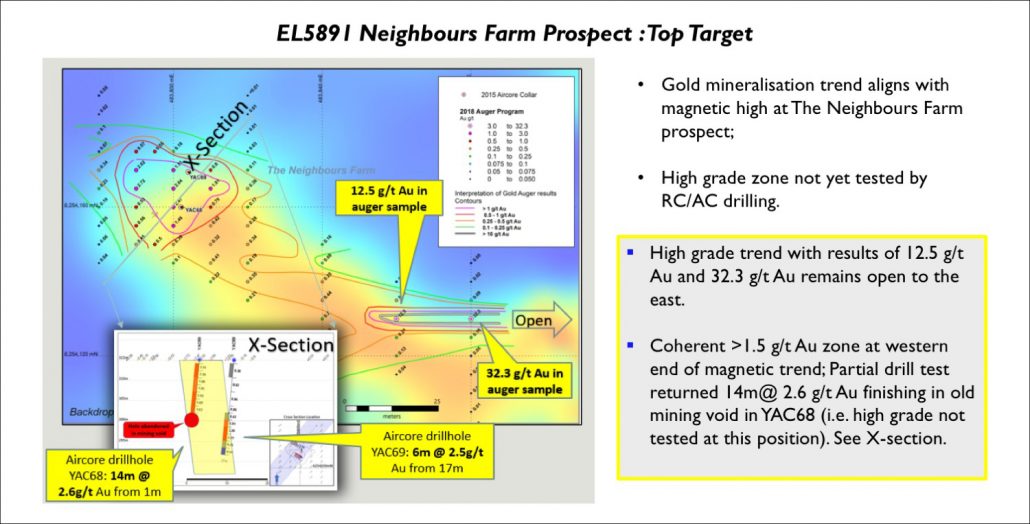

Phillip Thomas, President & CEO of AIS, commented, “AIS is very pleased to have secured this opportunity to explore and develop an advanced-stage gold project in the exciting historic gold district of New South Wales, Australia. The Project is geophysics and drill- ready with 3,795 metres over 14 drill holes already completed and a substantial drill hole and magnetic survey database from other explorers from 1953 when BHP explored the area. The goal is to fast-track the Project towards resource estimation, feasibility and then mine development in the Neighbour, Last Hurrah, Walsh, Adelaide, and Holland deposits. The Adelaide mine area is not yet drilled. The Company plans IP geophysics and drilling as soon as possible with a focus onBulk Tonnage, near surface lower grade opportunities; Down dip/plunge and along strike of Holland/Walsh’s/Last Hurrah 500 m trend, Bonanza grade narrow vein targets near Adelaide Mine and down dip/plunge of 140 m strike workings to 55 m depth, grades equivalent to 1 m@24 g/t Au; Bonanza grade narrow vein targets at Neighbours Farm; Down dip/plunge of 14 m @ 2.6 g/t Au (entered old stope) from 1 m and along strike to 32.3 g/t Auger result.”

Fig 4. Top target the Neighbours Farm prospect.

Fig 4. Top target the Neighbours Farm prospect.

Planned Property Exploration Program

The tenement offers:

- Mineralised system of significant scale containing numerous ‘walk-up’ drill targets;

- Open high grade near surface intersections;

- Untested historic workings with reported high grades;

- Bulk tonnage lower grade potential;

- Oxide heap leach planned;

- Land access secured and excellent relationships established.

Our aim is to define the oxide resource, provide targeting guidance for deeper exploration. In summary the program entails 5000 metres percussion reverse circulation with downhole geophysics (Optical televiewer), 240 metres of oriented diamond core holes (HQ3), QA/QC, DGPS survey, downhole surveys, handheld pXRF multi-element, gold fire assays with 50g charge on 1m intervals; preliminary metallurgical test work, resource estimate of oxide mineralisation, and an IP survey to guide further exploration at depth. Our estimated Cost is approximately AU$650,000. The planned outcome will be a NI43-101 Compliant gold oxide resource with IP Chargeability and Resistivity Inversions for drill hole guidance.

Due Diligence

AIS has paid a AU$10,000 option fee per month, for three months to complete due diligence. The Company plans to prepare a National Instrument 43-101 Technical Report on the Project in accordance with regulatory requirements. All the work since 2001 has been done by Denis Walsh, a Qualified Person under NI 43-101. He is also the senior geologist working at Fosterville gold mine in Victoria that produced 155,106 ounces of gold this past quarter.

Acquisition Terms

Under the terms of the LOI, AIS has paid an AU$10,000 (approximately, C$9,500) deposit per month for an exclusivity period of 90 days during which time AIS will undertake due diligence and the parties will finalise and enter into a definitive agreement. As part of the LOI, Walsh will be granted 2% net smelter return royalty on the first 50,000 oz production.

Under the terms of the LOI, AIS will acquire a 60% interest in the Yalgogrin Gold Project in exchange for (i) a cash payment of AU$275,000 (approximately, C$261,250) on the definitive agreement date, (ii) the issuance, on the definitive agreement date, of AU$125,000 (approximately, C$118,750) of AIS common shares; to acquire the remaining 40% AIS will iii) incur exploration expenditures of AU$750,000 (approximately, C$712,500) in the 12 month period post the signing of the definitive agreement. and (iv) the issuance on the date that is 18 months from the Definitive Agreement date of AU$600,000 (approximately, C$570,000) of AIS common shares at the 20-day volume-weighted average price (“VWAP”) immediately preceding such date.

Closing of the Definitive Agreement is subject to, among other things, the receipt of all necessary approvals and all conditions having been satisfied or waived with respect to the terms of the LOI including the approval of the TSX Venture Exchange (the “Exchange”). Technical information in this news release has been reviewed and approved by Phillip Thomas, a Director of AIS, who is a Qualified Person under the definitions established by the National Instrument 43-101.

About AIS Resources Limited

AIS Resources Ltd. is a publicly traded investment issuer listed on the TSX Venture Exchange focussed on precious and base metals exploration. The Company is managed by a team of experienced mining and geological professionals. AIS has been involved in manganese trading from mines in Peru. In July 2020, AIS entered into an agreement to acquire and develop the Yalgogrin Gold Project in central New South Wales, Australia.

For further information, please contact:

Phillip Thomas, Chief Executive Officer, AIS Resources Ltd.

T: +1-747 200 9412

E: pthomas@aisresources.com

Or

Martyn Element, Executive Chairman

T: +1-604 687 6820

E: melement@aisresources.com

Website: www.aisresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ADVISORY: This press release contains forward-looking statements. More particularly, this press release contains statements concerning the anticipated use of the proceeds of the Private Placement. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The intended use of the proceeds of the Private Placement by the Corporation might change if the board of directors of the Corporation determines that it would be in the best interests of the Corporation to deploy the proceeds for some other purpose. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)