A.I.S. Resources Arranges a Monthly Manganese Supply of 1,500 Tonnes and Sells Initial Shipment of 454 Wet Metric Tonnes Manganese

Vancouver, British Columbia – A.I.S. Resources Limited (TSX: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announced today that the Company has arranged 1,500 tonnes a month of manganese supply.

Highlights of the AIS Resources Manganese Production from Peru:

- AIS has contracted 1,500 tonnes per month of supply from the following sources:

- Arce Manganese group has 1,000 tonnes available for supply and can provide 1,000 tonnes per month of 43% Mn.

- San Jorge mine has 525 tonnes ready to ship to the specification contracted. A sample of the 525 tonnes mined showed 54% MnO. This supply has been paid for.

- AIS has paid a deposit to Sudamerica for 500 tonnes of 44% lump manganese (“Mn”).

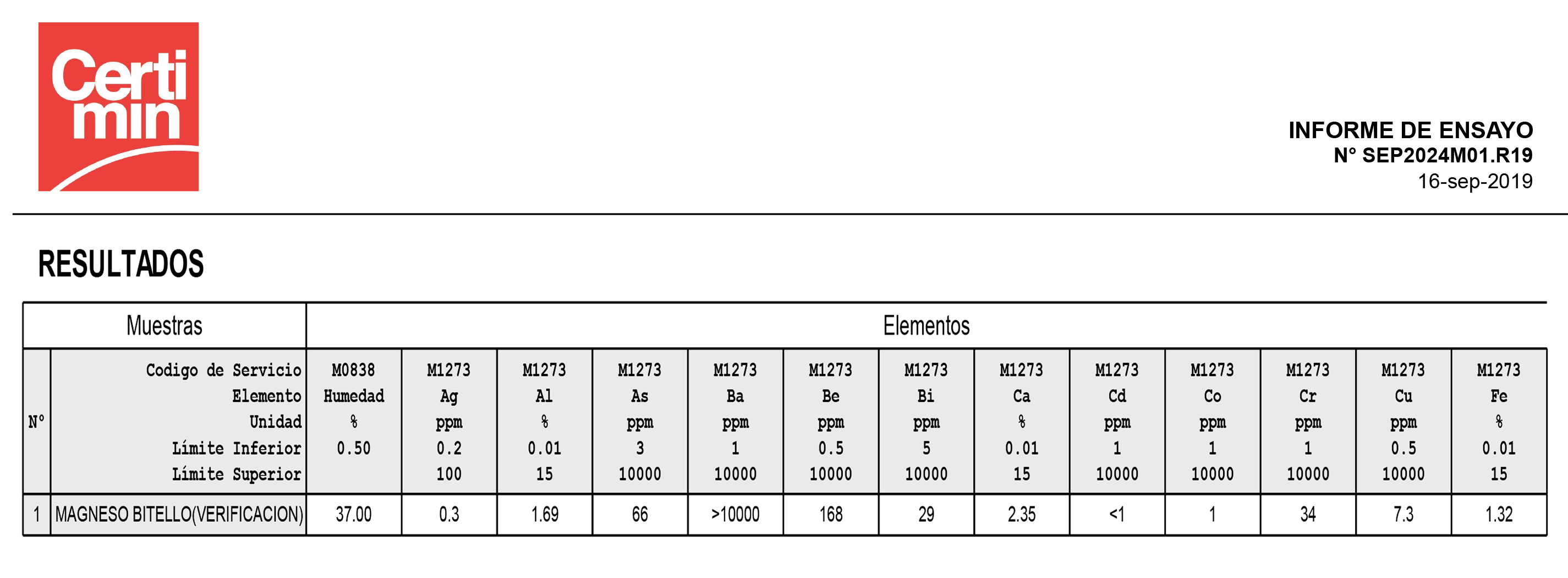

Figure 1 Assay Results – San Jorge Mine Peru

- We are obtaining quotes to ship from Salaverry Peru, reducing our trucking costs and shipping by loading bags directly into the hold of handymax ships.

- The current market price for low iron content Manganese is $4.35 per point or at 44% MN benchmark $191.40 per Wet Metric Tonne. Our suppliers have lowered their prices in line with the reduction in the market price to enable A.I.S to maintain profits.

Expanding Supply of Manganese

- Our CEO visited Bolivia in the past week and has sampled the seller’s ore which assayed at 59.4% MnO or approximately 45.7% Mn. They have the capacity to produce 30,000 tonnes per month and the resource is estimated at 1,000,000 tonnes. The product will be shipped from Antafagasta in Chile. AIS is currently investigating trade finance for up to $5 million per month.

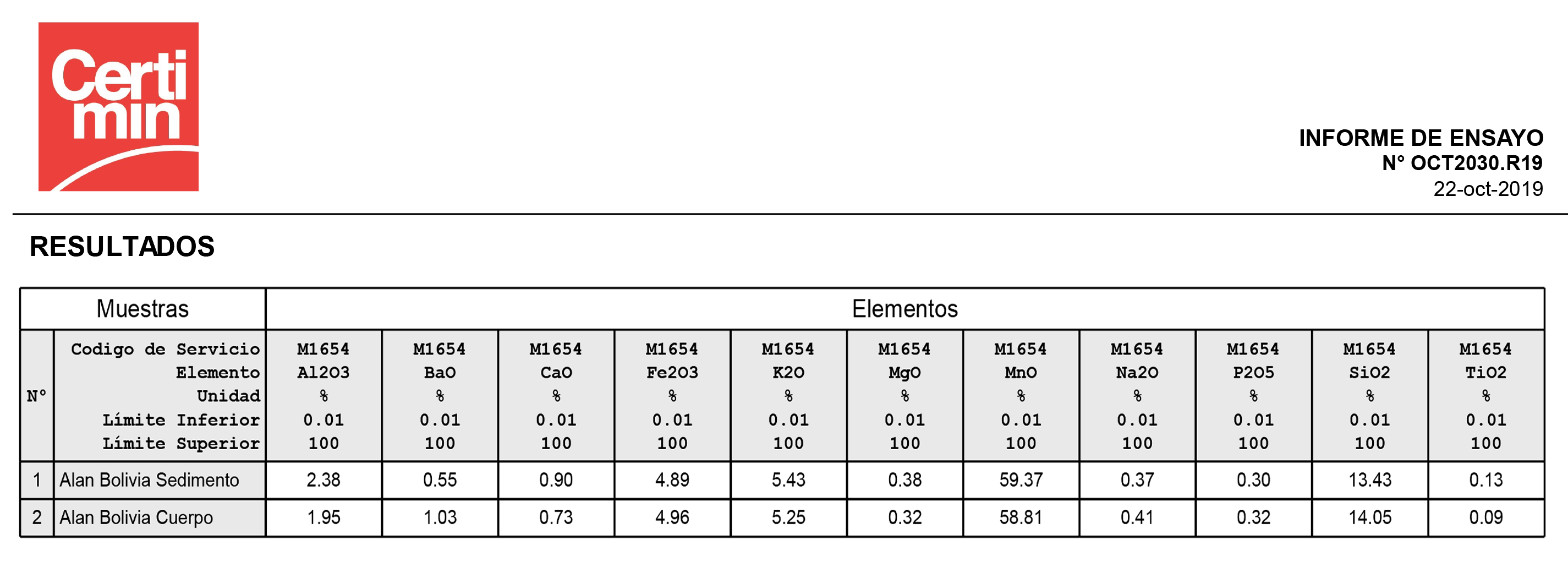

Figure 2 Assay Results – Bolivia

- We are negotiating with a supplier from Namibia for 10,000 tonnes a month of 44% Mn, on a CFR basis Tianjin, China.

“After a lot of hard work I am delighted we made good progress to expand our production supply capacity. Our CIQ certificate will open the door to access many more buyers around the world and key Japanese traders.” AIS Resources President and CEO, Phillip Thomas stated, “The use of manganese in steel is expanding from the construction industry to the high wear mining equipment market. For example, Xtraalloy steel has 24% Manganese. We will be targeting these producers who require up to 50,000 tonnes a month”.

AIS Resources Sells 454 Tonnes Manganese to Chinabase

AIS has sold 454 tonnes of manganese to Chinabase, a large trading company in China. The 21 containers are currently being sampled by China Import and Quarantine (“CIQ”). Payment is expected when CIQ is completed.

About A.I.S. Resources

A.I.S. Resources Ltd. is a TSX-V listed investment issuer that is managed by experienced, highly qualified professionals who have a long track record of success in lithium and manganese trading, exploration, production and capital markets. Through their extensive business and mining networks, they identify and develop projects worldwide that have strong potential for growth with the objective of providing significant returns for shareholders. The Company’s current activities are focused on the mining and trading of manganese ores in Peru, and exploration and development of lithium brine projects in northern Argentina.

On Behalf of the Board of Directors, AIS Resources Ltd.

Phillip Thomas, President & CEO

Corporate Contact

Phillip Thomas

President & CEO

T: +1-747 200 9412

E: pthomas@aisresources.com

Martyn Element

Chairman

T: +1-604 687 6820

E: melement@aisresources.com

Website: www.aisresources.com

ADVISORY: This press release contains forward-looking statements. More particularly, this press release contains statements concerning the anticipated use of the proceeds of the Private Placement. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The intended use of the proceeds of the Private Placement by the Corporation might change if the board of directors of the Corporation determines that it would be in the best interests of the Corporation to deploy the proceeds for some other purpose. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)