Vancouver, British Columbia – October 6, 2016 – Marc Enright-Morin, CEO of A.I.S. Resources Limited (TSX – NEX: AIS.H) (the “Company” or “AIS”) is pleased to announce the engineering and geological team for the Company’s Argentinian projects.

The CEO of the Company, Marc Enright-Moring said, “We are pleased to be associated with such a world class team, who all have such extensive knowledge across all sectors of the lithium process; from discovery to production. We are now equipped with everything we need to fast track our projects.”

The team consists of:

Mr. Phillip Thomas BSc Geol MBusM MAIG MAIMVA MCIM CMV (Marketing, Capital Finance, Geology)

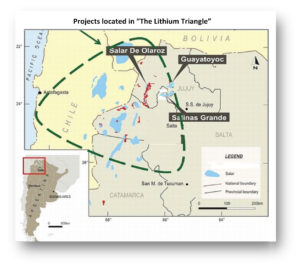

Phillip has degrees in Geology and Business Marketing and is a certified mineral valuer. He specialises in finance and capital raising, management of mining companies, planning, development and management of mining projects, having established a number of significant exploration projects in Mexico, USA, Chile, Argentina, Arizona and Australia. Previously he was actively engaged in developing two major lithium projects in Argentina with Dr. Sorentino. Phillip has specialised in the exploration, development, financing and sales of lithium deposits within the public company structure.

He has extensive knowledge of the lithium carbonate markets in Japan, Korea, China and Taiwan. From 2003 to 2008 he was CEO of Admiralty Resources, worked on the Rincon Salar project in Argentina, and prepared the bankable feasibility study for the exploitation of the Salar del Rincon. He raised more than $6m for this project and sold it in 2008. He and his team constructed a laboratory, pilot plant and developed a process to evaporate the brines in half the usual time. Phil has been active in three lithium projects in the last 4 years. Phillip holds a M Bus Marketing degree with high distinction from Monash University, a Bachelor of Science (Geology) degree and a Diploma in Finance. He is a member of the Australian Institute of Geoscientists and a certified Mineral Valuer with the Australasian Institute of Mineral Valuers and Appraisers.

Dr. Carlos Sorentino (Chief Chemical Engineer)

Dr. Sorentino has degrees in engineering and economics. He specialises in the valuation, planning, development and management of mining projects, having established a number of significant exploration projects in South America. He has completed a number of major lithium projects in Argentina . Dr. Sorentino has specialised in the exploration, metallurgy and development of the mineral resources of evaporitic deposits, particularly in the Andes Cordillera. From 1996 to 2001 he prepared the detailed engineering and a bankable feasibility study for the exploitation of the Salar del Rio Grande, and from 2004 to 2008 developed the basic and detail engineering and directed the establishment of a pilot plant for a Lithium project in the Salar of Rincon, both of them in Salta, Argentina. More recently, he formulated a detailed business plan for the exploitation of lithium in the Salar of Pozuelos.

Dr. Sorentino’s doctoral dissertation was in the field of mineral economics. He also holds a Masters of Environmental Studies degree, a Bachelor of Engineering (Chemistry) and a Diploma in Radioisotopes Technology. He is a Fellow and a Chartered Professional of the Australasian Institute of Mining and Metallurgy, a member of the Mineral Industry Consultants Association, a member of the American Chemical Society and a Director and Certified Mineral Valuer with the Australasian Institute of Mineral Valuers and Appraisers.

Dr. Sorentino holds directorships in a number of private corporations in Australia, Argentina and elsewhere. He is an honorary Associate in Macquarie University, Wollongong University, University of Jujuy (Argentina) and in the Kalgoorlie School of Mines.

Professor Dr. Ricardo Alonso (Geology)

A Doctor in Geological Sciences, researcher and university professor, Ricardo Alonso specializes in Geology of the Central Andes. He graduated as a Geologist from the National University of Salta (UNSA) in 1978. Since 1984 he has been a Professor of UNSA, teaching Systematic Mineralogy, Geology of Evaporites and History of Latin American Geology. He has been a Visiting Researcher at Cornell University, NY, Potsdam University, Germany and a guest professor at the International University Menendez Pelayo, Santander, Spain. Since 1984, Dr. Franks has been a researcher of the National Science Council of Argentina (CONICET) and has been involved in international projects with the National Science Foundation (USA), National Geographic Society (USA), Cornell University (Program INSTOC-NASA), Nebraska University (USA), Natural Science Museum (Madrid, Spain), University of Barcelona (Spain), University of Potsdam (Germany) and Dokuz Eylull University (Izmir, Turkey), amongst others.

A prolific author, he has written numerous papers and over 50 books in his field, including “Diccionario Minero Hispanoamericano” published in Madrid in 1995 by the Spanish National Research Council.

Dr. Alonso is the recipient of several awards, including the Journalism Prize in History and Culture (ADEPA, Bs. As., 1999), the “Miner of the Year 2007” (Argentinean Mining Industry, Bs. As.) and the Argentinean Geological Association Prize 2010 (in the category of Ore Deposits).

Dr. Alonso is a Fellow of the Geological Society of America and of the Society of Economic Geologists. He was the Secretary of Mining and Energy for the Salta Government, (Argentina), 2005-2007 and is an Elected Member of Legislative Lower House of the Province of Salta (2009- 2013).

About A.I.S. Resources

A.I.S Resources Limited a TSX-V listed investment issuer, was established in 1967 and is managed by seasoned professionals who have a long track record of success in the capital markets. Through their extensive business network, they identify and develop early stage projects worldwide that have strong potential for growth with the objective of providing returns for shareholders.

Contact

A.I.S. Resources Limited

Marc Enright-Morin

President and CEO

T: 778-892-5455

E: memorin@aisresources.com

W: www.aisresources.com

ADVISORY: This press release contains forward-looking statements. More particularly, this press release contains statements concerning the anticipated use of the proceeds of the Private Placement. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The intended use of the proceeds of the Private Placement by the Corporation might change if the board of directors of the Corporation determines that it would be in the best interests of the Corporation to deploy the proceeds for some other purpose. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)