A.I.S. Resources Announces Financing and Contract Renegotiation

Vancouver, British Columbia – August 21, 2017 – A.I.S. Resources Limited (TSX – NEX: AIS.H, OTCQB: AISSF) (the “Company” or “AIS”) announces the expiry of its original contract with Ekeko SA. The Company is negotiating with Ekeko for an additional option for a period of twelve months.

AIS also announces a non-brokered private placement of up to 12.5 million units of the Company at a price of $0.20 per unit for gross proceeds of up to $2.5 million.

Each unit will consist of one common share and one transferrable share purchase warrant. Each warrant will entitle the holder thereof to purchase one additional common share for a period of 12 months from the closing date of the offering at a price of $0.30 per common share provided that if the closing price of the common shares of the Company on any stock exchange or quotation system on which the common shares are then listed or quoted is equal to or greater than $0.45 for a period of fifteen (15) consecutive trading days, the Company will have the right to accelerate the expiry of the warrants to a date that is not less than ten (10) business days from the date notice is given. The Company will pay up to 7% finders fees and 7% finders warrants.

About A.I.S. Resources

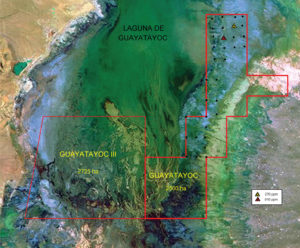

A.I.S Resources Limited a TSX-V listed investment issuer, was established in 1967 and is managed by experienced, highly qualified professionals who have a long track record of success in lithium exploration, production and capital markets. Through their extensive business and scientific network, they identify and develop early stage projects worldwide that have strong potential for growth with the objective of providing significant returns for shareholders. The Company’s most recent activities have been the exploration of lithium properties in Northern Argentina.

On Behalf of the Board of Directors,

AIS Resources Ltd.

Marc Enright-Morin, President and CEO

Contact

A.I.S. Resources Limited

Marc Enright-Morin

President and CEO

T: 778-892-5455

E: memorin@aisresources.com

W: www.aisresources.com

ADVISORY: This press release contains forward-looking statements. More particularly, this press release contains statements concerning the anticipated use of the proceeds of the Private Placement. Although the Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The intended use of the proceeds of the Private Placement by the Corporation might change if the board of directors of the Corporation determines that it would be in the best interests of the Corporation to deploy the proceeds for some other purpose. The forward-looking statements contained in this press release are made as of the date hereof and the Corporation undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)