A.I.S. Resources Identifies Prospective Drill Targets at Reliance Reef and Provides Bright Gold Project Update

May 19, 2022

Vancouver, British Columbia – A.I.S. Resources Limited (TSX-V: AIS, OTCQB: AISSF) (the “Company” or “AIS”) announces that the Company has identified four low impact drill hole locations in the newly developed Reliance Reef area. Drilling, has been designed to test the exploration prospect at Reliance and evaluate the drill rig suitability for resource drilling at Golden Bar. The Company is collaborating with the State Government roads manager and the Company’s community relations team is continuing to engage with the community to advise on the proposed work.

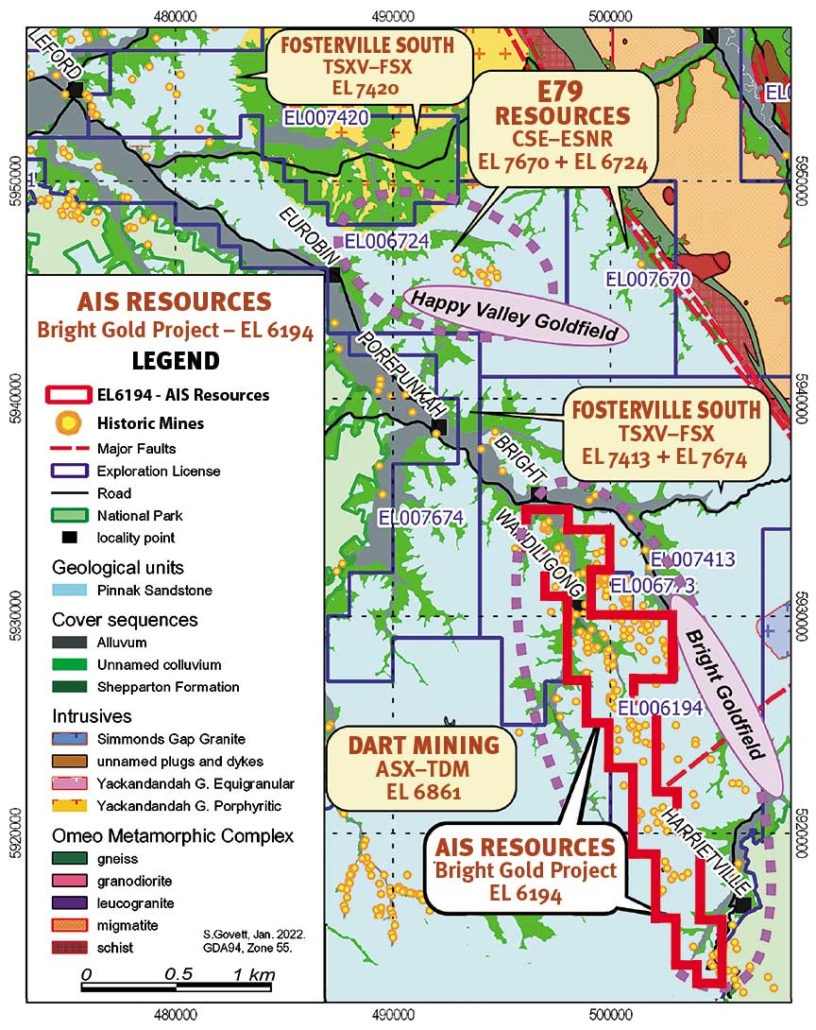

Fig. 1 – Local Area Map showing highly prospective gold resource area play which includes E79 Resources (CSE:ESNR), Fosterville South (TSX.V:FSX), and Dart Mining (ASX:DTM).

Fig. 1 – Local Area Map showing highly prospective gold resource area play which includes E79 Resources (CSE:ESNR), Fosterville South (TSX.V:FSX), and Dart Mining (ASX:DTM).

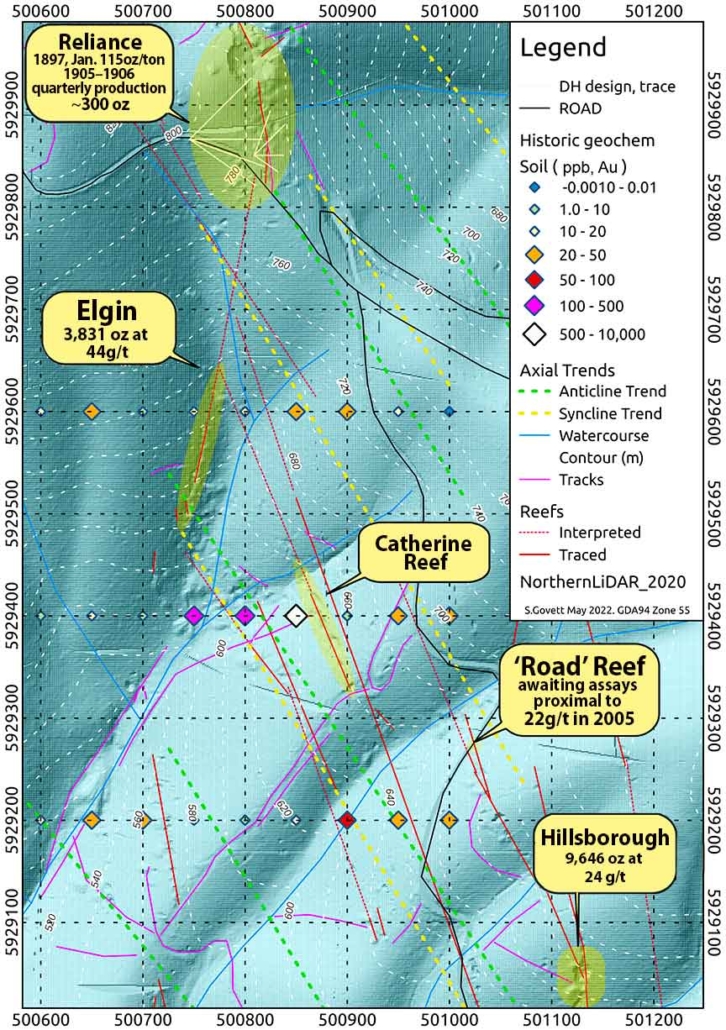

Hillsborough-Catherine-Elgin-Reliance Reefs and Mines – Historical Analysis

Recent historical research of production related to the Reliance Mine finds it the richest producer in the district. A newspaper article from 1897 shows that a crushing from ore at surface yielded an incredible 115 oz./ton or 3,576.5g/t[1]. Other historical yields included 3831 oz at 44g/t at the Elgin Reef, and 9646 oz at 24g/t at the Hillsborough Reef. Little follow-up production was uncovered with two references of production showing 335oz for the quarter of June 1905[2] and 274oz. for the March quarter of 1906[3].

Figure 2: LiDAR, surface geochemistry, and structural interpretation at Reliance-Elgin-Hillsborough. Reliance drill program displayed in the north.

Reliance Drill Program

Recent three-dimensional (3D) modeling utilizing open file LiDAR demonstrates the high probability that the upper Elgin Reef is the same as that worked at Reliance.

A maiden drill program here is designed for 815m and staged in two parts.

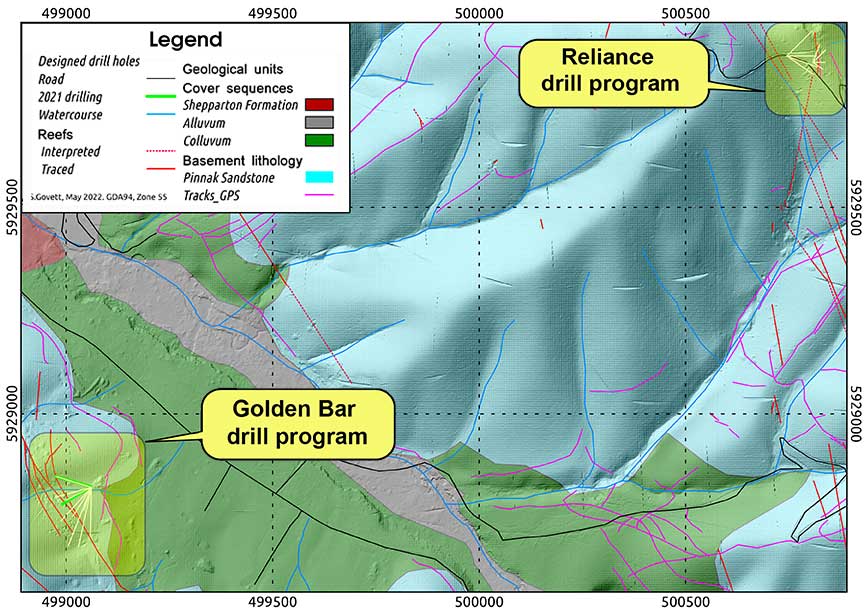

Fig. 3: Relative prospect map of Reliance and Golden Bar drill programs at EL6194.

There is a near target drill fan program to test width, proximity, and strike orientation with a further step out program to test continuity at depth and orientation. Also, it is important to understand the relationship of this saddle reef to any fold hinges that are projected to exist locally as 3D modeling demonstrates that the lower Elgin Reef occurs in proximity to an anticline which at this point is mapped to be 4m wide from historic mine plans. Gold can be found to deposit in saddle reef structures.

Fig 4: 11 m wide face sampled (SF01) proximal to 2005 sample grading 22g/t. Looking south.

It is anticipated that the program should be able to determine the shoot below and between historic workings lending further credibility to the concept that the Reliance Reef and upper Elgin Reef are the same structure. It is important to note that the Elgin workings were intersected by a low angle post mineralization fault (hence the upper and lower Elgin Reefs) with displacement of unknown dimension. There is also the potential of other low angle late faults to be encountered in this drilling.

Golden Bar Drill Program

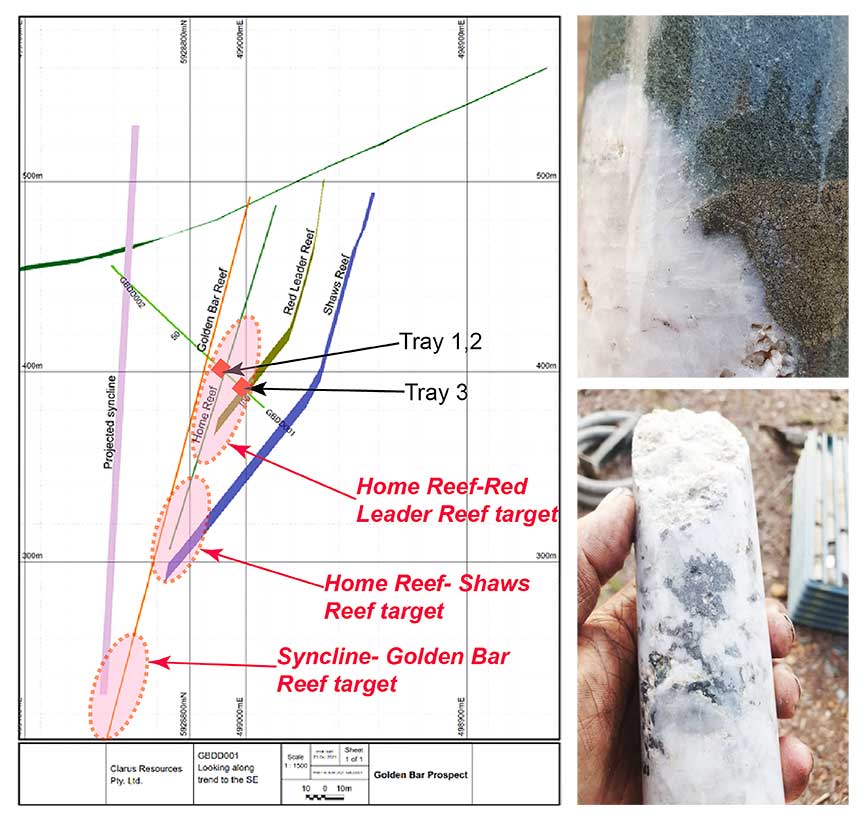

A follow-up drill program for 1,665m has been designed and is displayed in figure 5.

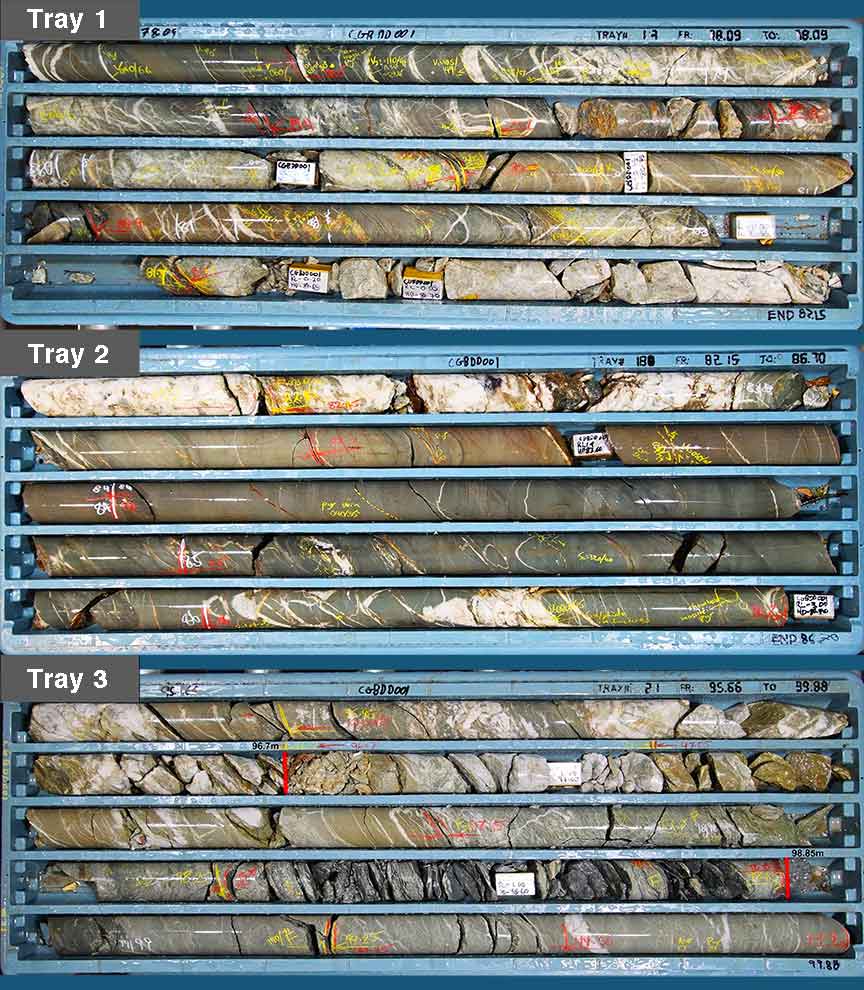

The first drill hole here (GBDD001) was 2.85m@0.33 g/t gold and 4,070ppm arsenic from 96.7mon the Red Leader fault. We are awaiting assay results from GBDD002. Better gold grades, similar alteration and rock textures are expected as shown in figure 7.

An additional feature of the drill program at Reliance is for purposes of assessing noise emissions. This data will be incorporated with a noise management plan for the benefit of local residents at the Golden Bar prospect. Collaboration with the State Government roads manager and community engagement is ongoing.

Fig. 5 Left: Drill section for GBDD001, looking south-east. • Fig. 6 Top Right: Semi-massive pyrite associated with quartz-carbonate vein. • Fig. 7 Lower Right: Vein hosted massive euhedral arsenopyrite, GBDD001 82.8m.

Fig. 8: Tray 1 for Home Reef horizon 78.9-82.95m in GBDD001 (see section in figure 6). Tray 2 for Home Reef horizon 78.9-82.95m in GBDD001 (see section in figure 6). Tray 3 for Red Leader Reef horizon 96.7-98.85m in GBDD001 (see section in figure 6.). 2.85m@0.33m g/t gold and 4,070ppm arsenic from 96.7m.

A historical account of production at Golden Bar comes from the last records of mining immediately above these drill intersections by way of the Kenny, 1966[4]. Earliest records of the prospect are incomplete, with surface mining estimated to have initiated around 1865, concluding in 1905 on mining fronts associated with the Home Reef and Shaws Reef. It was calculated that Shaw’s Reef yielded a grade of 10.14 g/t from 487.7 ton of ore and Home Reef yielded 22.28 g/t from 287 ton of ore. The weighted average from a total of 779.3 ton of ore is 14.66 g/t, with auriferous pyrite contributing between 1.2-1.5 g/t[5]. Both of these reefs plunge to the south-east at about thirty degrees.

As announced on January 12, 2022, AIS entered into a joint venture with Clarus Resources Pty. Ltd. to explore the highly prospective Bright Gold Project Exploration Licence EL6194, that covers 57 sq km of land along the Bright-Myrtleford Highway. The exploration licence is surrounded by Dart Mining (ASX:DTM), Fosterville South (TSX.V:FSX), and E79 Resources (CSE:ESNR).

Martyn Element, Chairman of AIS stated, “We are pleased to have completed a recent financing and look forward to commencing the drilling program at the Reliance Reef and Golden Bar Reef, two promising target zones of the several prospects at Bright El-6194.”

Fosterville-Toolleen Gold Project Update

AIS has completed the soil sampling program, the geophysics review, and a second geophysics review. The company is now preparing for drilling up to 10 holes at approximately 100-120m. Our community engagement team is currently working with land and traditional owners to advise them of the proposed work pursuant to the latest DJPR Earth Resources guidelines.

Explanation of Historical Estimates

“Historical estimate” means an estimate of the quantity, grade, or metal or mineral content of a deposit that an issuer has not verified as a current mineral resource or mineral reserve, and which was prepared before the issuer acquiring, or entering into an agreement to acquire, an interest in the property that contains the deposit and is not NI43-101 compliant nor JORC compliant if an Australian reporting explorer. The statement does not imply that a resource has been estimated and gives no indication that the deposit is economic or not. An issuer must not disclose any information about a mineral resource or mineral reserve unless the disclosure uses only the applicable mineral resource and mineral reserve categories.

Technical information in this news release has been reviewed and approved by Phillip Thomas, BSc Geol, MBM, FAusIMM MAIG MAIMVA(CMV) who is a Qualified Person under the definitions established by the National Instrument 43-101 and is President, CEO of A.I.S. Resources Ltd.

- [1] Source: Albury Banner and Wodonga Express, 29th January 1897,pp 8-9.

- [2] Source: Australian Town and Country Journal, 28th June 1905, p.17

- [3] Source: Weekly Times, 31st March 1906, p.35

- [4] Geological Survey of Victoria Bulletin No.44, pp.39-40.

- [5] Ibid

About A.I.S. Resources Limited

A.I.S. Resources Limited is a publicly traded investment issuer listed on the TSX Venture Exchange focused on lithium, gold, precious and base metals exploration. AIS’ value add strategy is to acquire prospective exploration projects and enhance their value by better defining the mineral resource with a view to attracting joint venture partners and enhancing the value of our portfolio. The Company is managed by a team of experienced geologists and investment bankers, with a track-record of successful capital markets achievements.

AIS owns 100% of the 28 sq km Fosterville-Toolleen Gold Project located 9.9km from Kirkland Lake’s Fosterville gold mine, a 60% interest in the 57sqkm Bright Gold project (with the right to acquire 100%), a 60% interest in the 58 sq km New South Wales Yalgogrin Gold Project (with the right to acquire 100%), and 100% interest in the 167 sq km Kingston Gold Project in Victoria Australia near Stawell and Navarre. AIS has further options to acquire three lithium licences in the Pocitos and Cauchari Salars in Argentina and, also has 20% joint venture interests with Spey Resources Corp. in lithium brines in Argentina at the Incahuasi and Pocitos Salars.

On Behalf of the Board of Directors,

AIS Resources Ltd.

Phillip Thomas, President & CEO

Corporate Contact

For further information, please contact:

Phillip Thomas, Chief Executive Officer

T: +1-323 5155 164

E: pthomas@aisresources.com

Or

Martyn Element. Chairman

T: +1-604-220-6266

E: melement@aisresources.com

Website: www.aisresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ADVISORY: This press release contains forward-looking statements. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The forward-looking statements contained in this press release are made as of the date hereof and the Company undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)