Lithium Miners News For The Month Of March 2018

Lithium spot and contract price news – Lithium spot prices were stable, while 2018 LCE global contract prices are about 20% higher than 2017.

Lithium market news – Lithium giant Albemarle contradicts Morgan Stanley on electric vehicle growth. The EV take-up rate, and therefore lithium demand, will be much greater than MS claims. Lithium company news – The lithium deals continue, following Volkswagen’s stunning $25b battery deal with leading battery manufacturers.

Welcome to the March 2017 edition of the lithium miner news. This past month saw the stunning $25b battery deal between Volkswagen (OTCPK:VLKAY) and Samsung SDI (OTC:SSDIY), LG Chem (OTC:LGCEY), and Contemporary Amperex Technology Ltd [CATL], as well as the POSCO lithium deal with Pilbara Minerals (OTCPK:PILBF), JR Optimum Nano talks to increase their share in Altura Mining (OTCPK:ALTAF), and CATL’s buy into North American Lithium. It also saw the completion of the Orocobre (OTCPK:OROCF) – Toyota Tsusho (OTC:TYHOY) deal.

Lithium spot and contract price news

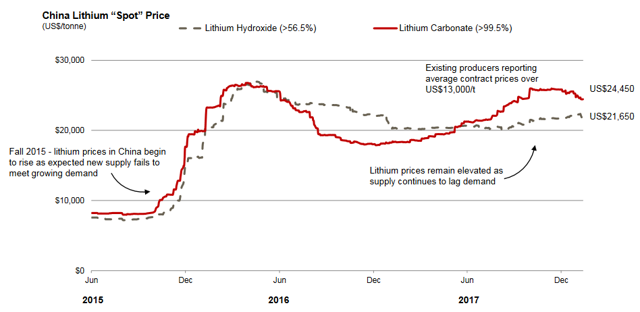

During March, 99.5% lithium carbonate China spot prices were again little changed, and are down 1.7% over the past 3 months. Global Lithium Carbonate Equivalent [LCE] contract prices are in the range of USD 13-16,000/tonne.

Lithium China Spot Prices

.

Source: Lithium Americas January 2018 company presentation

Lithium demand versus supply outlook

On February 27, Reuters reported: “Lithium glut? No way, say industry executives eyeing demand. Forecasts for a glut in lithium, a major ingredient in rechargeable batteries for electric vehicles, fail to account for strong demand and how complicated it is to process and mine, industry executives and analysts said. Forecasts of oversupply also fail to take into account that few lithium processors have the capacity and ability to produce the very high-grade lithium compounds that batteries need, said analyst Andrew Miller at Benchmark Mineral Intelligence, a UK-based battery metals consultancy. He said he does not see a glut occurring in the next few years although the market could see small surpluses.”

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)